News

Chinese banks' asset quality to deteriorate in 2020

Officials have ordered banks to lower lending rates and extend deadlines amidst the epidemic.

China's lenders to allow higher bad loans for COVID-19-hit firms

The People’s Bank of China will support qualified firms in order to resume production.

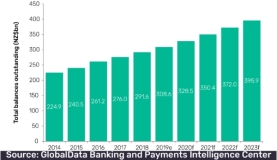

New Zealand retail lending to hit $265.6b in 2023

Total retail loan balance outstanding is set to reach the same amount.

HSBC faces third major overhaul

Biggest market Hong Kong is hit with anti-government protests and the COVID-19 outbreak.

Singapore to record anaemic loan growth of 1.5% in 2020

The COVID-19 and the expected monetary easing will weigh on banks.

Taiwan banks will manage the impact of COVID-19 oubtreak: Fitch

But they will experience stress from SME and personal loans.

Asian Development Bank worsens debt conditions: World Bank head

He hit the development banks in Asia, Africa, and Europe for lending too quickly to debt-heavy countries.

Weekly Global News Wrap: Credit Suisse CEO out over spying scandal; Wells Fargo chief reshuffles management

And German online bank N26 exits the UK.

Asian bankers ready for nCov deal droughts

Several auctions and potential Chinese IPOs are being delayed or re-assessed.

Hong Kong banks' earnings to remain weak as coronavirus cripple operations

Around 20-30% of bank branches will likely temporarily close or shorten operating hours.

Majority of Gen Z use credit cards: survey

They have a median balance per consumer of $555 (HKD4,316).

Macau banks have sufficient buffers to weather near-term nCov risks

Outlook hangs on parent banks’ abilities to provide support.

Chinese financial firms face heightened risk from coronavirus outbreak

A significant loosening in the monetary policy will exert additional pressure on bank capital.

Malaysian banks boast ample capital despite higher buffer requirement

The central bank has currently set the countercyclical buffer at 0%.

Singapore's central bank urges boosting of finance measures vs nCov

Internal controls and demands for financial services should be managed.

Indonesian banks' cost pressures to persist in 2020

They will likely shift to higher cost funding in anticipation of loan demand growth.

Advertise

Advertise