News

ADB temporarily closes headquarters due to COVID-19

A visitor reportedly tested positive for the coronavirus.

ADB temporarily closes headquarters due to COVID-19

A visitor reportedly tested positive for the coronavirus.

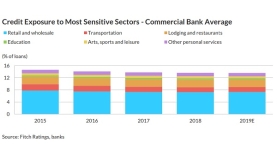

Chart of the Week: Half of Korean banks' loan quality imperiled by prolonged COVID-19 outbreak

This could impact the broad service and manufacturing sectors that make up about 58% of loans.

Weekly Global News Wrap: Financial firms beef up COVID measures; Europe mulls relief for banks

And Goldman Sachs is ‘very open’ to acquisitions.

ASEAN lenders on the defense amidst oil volatility, COVID-19

Falling visibility is evident despite lower prices and stimulus measures.

Vietnam's e-commerce market to reach $17.3b in 2023

Total online spending doubled to $9.4b in 2019 from $3.9b in 2015.

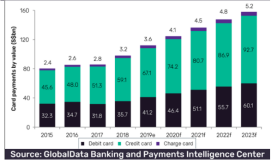

Singapore card payments market to hit $158b in 2023

Credit cards took the lion’s share in market value at 60% in 2019.

COVID-19 spells slow loan growth, higher NPLs for Philippine banks

Credit growth will likely be down to 8-10% in 2020.

StanChart consortium unveils Hong Kong virtual bank Mox

It will launch Asia’s first numberless bank card when it launches later this year.

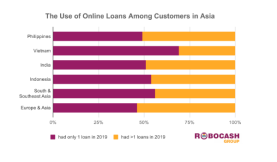

South Asians, SEA preferred repeat online loans in 2019

69% of Vietnamese had a single loan, but only 31% had repeat loans.

Asian Development Bank unveils new Singapore office

It comprises 12 specialists from ADB’s PSOD and Office of Public-Private Partnership.

Why you shouldn't miss ABF Retail Banking Forum 2020

Hear from the region’s top banking execs on how to stay ahead of changing industry trends.

Only 1 in 5 of APAC banks has an AML compliance strategy: study

Only 8% have an integrated system or specific executive to report these functions.

Malaysian banks' NPLs to rise as political turmoil adds to virus' impact

Asset quality problems may become permanent if disruptions persist.

Singapore banks' NIMs to degrade after US Fed surprise rate cut

DBS and UOB guided declines of 5-7bps.

Financial inclusion needs to be more than just about technology

Products need to be sustainable and scalable to meet the needs of the unbanked.

Malaysia's latest OPR cut needed to cushion COVID blow

The central bank slashed OPR to 2.5% amidst the virus’ global and domestic impacts.

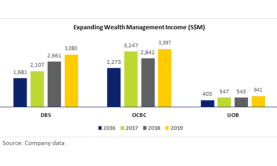

Big three banks' wealth income expanded 18% in FY2019

Wealth made up 31% of OCBC and UOB’s total income.

Advertise

Advertise