News

V3 Group and EZ-Link-led consortium join Singapore's digital banking race

BEYOND consortium has launched a bid for a digital full bank license with a focus on SMEs.

V3 Group and EZ-Link-led consortium join Singapore's digital banking race

BEYOND consortium has launched a bid for a digital full bank license with a focus on SMEs.

It's the most wonderful time of the year!

We're taking the time off!

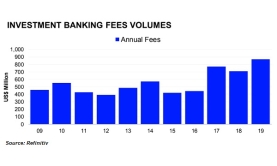

Singapore's investment banking fees hit record-breaking $868.1m in 2019

DBS Group clinched 11.8% or $138.79m of the total fee pool.

Japan's central bank begins lending ETFs to investors

This is part of its move to enhance market liquidity for the instrument.

Bank of Japan retains policy rate

It maintained its short-term interest rate at -0.1% and the 10-year government yields at 0%.

Nearly 1 in 3 Singaporean millennials prefer cashback cards

Cashback cards are preferred due to their instant benefits.

Thailand's central bank maintains policy rate at 1.25%

It will likely remain on hold in 2020, although a 25bp cut remains probable.

Chinese banks' asset performance deteriorates

Asset and loan growth slipped to 8.9% and 12.8% YoY in September, respectively.

Chart of the Week: Wealth and retail drive 60% of Singapore banks' fee income

DBS and OCBC’s private wealth AUM grew 15% CAGR in the past 6 years.

Weekly Global News Wrap: Saudi's biggest bank scraps $200b lender; Goldman Sachs to support green projects

And the PNC-Venmo fight highlights issue over who owns customers’ banking data.

Weak regulations heighten risks for Cambodian banks

The banking system is just one point shy of being amongst the highest-risk systems worldwide.

Obscure regulations, cybersecurity hinder adoption of open API: study

Almost two-fifths (38%) cited cybersecurity as the biggest risk.

Economic risks of Indonesian banks decline as per capita income rises

Robust profitability and high capital retention keeps the sector well-capitalised.

Indian asset risks rise amidst NBFC funding stresses

The economy has grown dependent on non-bank lenders.

South Korea NPL ratios still strong despite multi-year lows

Asset quality remains stable.

APAC NBFIs face negative outlook in 2020

Indian and smaller Chinese companies are amongst the most vulnerable.

Chinese financial firms' asset quality under duress amidst sluggish credit growth

Credit pressure variations affect small banks, distressed asset management and leasing firms.

Advertise

Advertise