Singapore

Standard Chartered launches new digital wealth management tool

The Personalised Investment Ideas tool is first for the retail banking industry in Asia.

Standard Chartered launches new digital wealth management tool

The Personalised Investment Ideas tool is first for the retail banking industry in Asia.

Weekly Global News Wrap Up: US banks look beyond trading; JPMorgan launches new payment processing network using blockchain

And find out why Canada's alternative lenders face bigger impact from new mortgage rules.

Closing in on open banking

How could open banking revolutionise how banks generate value?

Deutsche Bank launches TradePay in India

It is the first paperless import payment solution in the country. According to a release, Deutsche Bank’s TradePay uses the Reserve Bank of India’s Import Data Processing and Monitoring System (IDPMS) to verify import payments by checking them against details made available by the client on the system, eliminating the need for clients to share any physical documentation. The data is then enriched by the client to meet regulatory requirements, validated by Deutsche Bank and converted into a payment-ready state. Thereafter, clients can book FX contracts electronically through TradePay, thereby streamlining the payment process. The payment authorisation can be done directly on TradePay or via the importer’s ERP system. As a result, this digitised workflow solution can help to reduce complexities and delays in the supply chain, enhance controls and transparency of payments and increase speed of settlement, while meeting regulatory requirements. Anjali Mohanty, Head of Global Transaction Banking – India at Deutsche Bank, said: “The role of treasurers has increasingly become more strategic. They are looking to their bankers for solutions, such as TradePay, that helps them gain more efficiencies and future-proof their business.” Lisa Robins, Asia Pacific Head of Global Transaction Banking at Deutsche Bank, added: “By developing innovative solutions such as TradePay, we aim to play a role in the next phase of evolution for the transaction banking industry. We are delighted to have launched this product in India, where digitalisation is advancing rapidly.”

How Asia Pacific financial markets can get the most from distributed ledgers

With all the noise surrounding distributed ledger technology (DLT), you’d expect participants in financial markets in Asia Pacific and elsewhere to be racing full-bore to get ready for it. But many are not. Presented almost daily with new claims about DLT’s disruptive and revolutionary potential, some executives have begun to wonder when they’ll actually begin to see some benefits from the technology. Financial market participants know DLT is coming. In Asia Pacific and around the world, about 80% of executives at financial institutions surveyed by Bain & Company believe the technology will be transformative, and a similar percentage expect their organisations to begin using it before 2020. Yet, at the same time, they’re hesitant to commit resources now. Among the market participants Bain surveyed, 38% said they’ve adopted a wait-and-see approach to DLT. What’s holding them back? First, uncertainty. It is hard to predict the exact timing or path of DLT. There are different types of DLT platforms (public or private, for example) and a wide spectrum of potential applications, from narrow cases such as proxy voting and Know Your Customer (KYC) vetting to broader uses such as post-trade clearing and settlement for equities. The way DLT evolves in a localised market like Australia, for example, is likely to be different from how it develops in a more connected market like Hong Kong. Much will depend on regulations that are still being formulated. Some regulators, such as the Monetary Authority of Singapore, actively support DLT innovation. Getting ready for DLT requires substantial investment, and it can involve working through tricky and expensive issues with legacy IT systems. Some firms, in an attempt to preserve near-term competitive positions, are trying to delay industry-wide adoption of DLT. Yet companies that are willing to be proactive and strategic about DLT, even in such a challenging climate, can gain an edge. DLT has the potential to broadly affect financial markets, but the most significant near-term impact is likely to be on settlement and clearing. While a trader can now execute a transaction at lightning speed, it can take as long as three days for that transaction to settle. With DLT, execution, clearing, and settlement could occur simultaneously, minimising cost and credit risks. Bain estimates that across global financial markets, annual expense and capital cost savings from DLT could amount to 1-3 basis points of total global assets under management, or about $15 billion to $35 billion. DLT can eventually also play a role in improving reference data, including benchmark interest rates like Libor, replacing existing survey processes that are opaque and subject to abuse. A DLT-based benchmark-setting mechanism, possibly administered by trading venues and industry-wide utilities, could directly capture data from spot transactions. Beyond trading, DLT has the potential to change the way firms interact with their clients in areas such as proxy voting, digital identity management and KYC. Broadridge, a global leader in proxy communication services, is developing a system to help make US proxy voting more efficient, secure, and transparent. As financial markets evolve with respect to DLT, companies will face game theory-type decisions. If they promote the early adoption of DLT across the ecosystem, they may benefit, but they may also end up disrupting their own economics and competitive positions. Yet if they’re slow to embrace DLT, they run the risk of being left behind. The most valuable DLT innovations can’t be developed in isolation; they require collaboration among participants, exchanges, and regulators. With so many participants involved across so many jurisdictions and asset classes, the adoption process will be messy and piecemeal — and this is the heart of the challenge. It may make more sense to share the costs as well as the benefits through industry utilities. One way or another, firms that want to reap the benefits of DLT will have to make significant changes to their processes, policies, and IT architecture. As part of their efforts to make their IT systems ready for digital, leading companies are taking some of the preparatory steps that will be necessary for DLT. Once a company has a perspective on how DLT is likely to evolve in the areas in which it does business, it can develop a systematic approach and a multi-year roadmap. Whether a company prospers or flounders in the DLT-dominated markets of the future will depend, in large measure, on strategic decisions it makes today. Once a firm defines a DLT-readiness posture and a high-level roadmap, its next step is to outline specific no-regrets initiatives. Many of the investments a firm makes, especially in IT, can bring benefits regardless of the pace or shape of DLT adoption. Those market participants that thrive with DLT will spend less energy on making excuses for inaction and more on developing a strategic and longer-term approach that’s consistent with who they are, what they do, and where they operate. They’ll focus on driving themselves and the entire industry toward a more efficient ecosystem. The winners in DLT will be those that push the pace of change, rather than resist it.

Weekly Global News Wrap Up: Regulators near finalising new bank capital rules; EU bank watchdog to set conditions on cross-border trades

And French bankers face pressure to bring jobs home to Paris.

How blockchain is unchained in Singapore

Check out the latest developments around blockchain in Singapore.

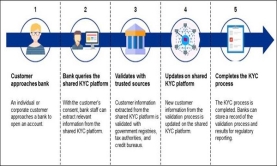

OCBC Bank, HSBC, MUFG complete Southeast Asia's first KYC blockchain proof of concept

The banks worked with Singapore's Infocomm Media Development Authority.

Bankers, this is the price of lacklustre cybersecurity (Part 1)

You’re gambling more than just money.

Weekly Global News Wrap Up: Banks' Brexit moving costs to hit $500m each; US regulators propose easier capital requirements

And Goldman Sachs is exploring bitcoin trading operation.

Singapore's domestic bank loans up 5.1% to US$465b in August

Business loans also grew 5.5% to US$277b.

Standard Chartered appoints Mikhail Brovman as global head, technology, financial markets

Mikhail Brovman has joined Standard Chartered as Global Head, Technology, Financial Markets on 2nd October. He is based in Singapore and reports to Dr Michael Gorriz, who is Group Chief Information Officer and interim Chief Information Officer, Corporate & Institutional Banking. Mikhail joins us from CLS, where he was a product management consultant. Prior to that, he was Chief Technology Officer of Project Edison, a prospective joint investment by Credit Suisse and a private equity investor in a new, un-consolidated broker/dealer trading platform in rates products. He was previously the Global Head (CTO) of CDSClear, where he was responsible for all IT aspects of CDSClear’s business, including expansion into US markets, SEF connectivity and Risk platform optimisation. He has also held senior IT leadership positions at UBS, Morgan Stanley and Barclays Capital where he delivered change programmes and integrated business solutions in Capital Markets and Investment Management. In his new role, Mikhail will be responsible for the entire technology value chain for Financial Markets (FM), working closely with other parts of ITO to ensure that it is run end to end. His remit will include the delivery of a seamless client experience based on efficient processing, the support of FM architecture and the delivery of a robust control environment. Mikhail will be a member of the FM Management team.

Asian Banking and Finance named Financial Trade Media Of The Year at the 2017 MPAS Awards

The winners were presented to around 200 guests.

Weekly Global News Wrap Up: EU bank watchdog loses 8% of its staff in two months; US bank customers paid almost $15b in fees

And JPMorgan Chase to hire 3,000 people in Poland.

HSBC appoints Philip Kunz as head of global private banking for Southeast Asia

HSBC announced the return of Philip Kunz as Head of Global Private Banking, South East Asia.

Which banks are launching virtual branches in Asia?

JP Morgan and Citi are amongst the banks deploying virtual branches.

Weekly Global News Wrap Up: Global transaction banking revenues up 4% to US$13.8b; Bank fees face 'secular downward' pressure

And Deutsche Bank CEO says automation will take a lot of jobs over the next 10 years.

Advertise

Advertise