China

Deutsche Bank appoints Mahesh Kini as head of global subsidiary coverage for APAC

He will report to Kaushik Shaparia, head of global subsidiary coverage, global transaction banking. Prior to this appointment, Mahesh was head of global transaction banking–China and head of corporate cash management for Greater China. He will continue to assume these roles in addition to his new position until a successor is announced. Kaushik Shaparia said, “The APAC region is a source of strength for Deutsche Bank. This is a vision we share with our global clients who also see APAC as a growth market. Cross-border business is a core part of what we do. In his new role, Mahesh will bring in a wealth of experience through his strong client connectivity, knowledge of Deutsche Bank’s corporate & investment banking platform and deep understanding of the APAC region in order to steer further growth in this business.” The global subsidiary coverage team is responsible for developing multinational client portfolios across all markets in APAC. The clients covered by this group are regional treasury centres and subsidiaries of corporates and non-bank financial institutions that are headquartered in the Americas, Europe and Asia.

Deutsche Bank appoints Mahesh Kini as head of global subsidiary coverage for APAC

He will report to Kaushik Shaparia, head of global subsidiary coverage, global transaction banking. Prior to this appointment, Mahesh was head of global transaction banking–China and head of corporate cash management for Greater China. He will continue to assume these roles in addition to his new position until a successor is announced. Kaushik Shaparia said, “The APAC region is a source of strength for Deutsche Bank. This is a vision we share with our global clients who also see APAC as a growth market. Cross-border business is a core part of what we do. In his new role, Mahesh will bring in a wealth of experience through his strong client connectivity, knowledge of Deutsche Bank’s corporate & investment banking platform and deep understanding of the APAC region in order to steer further growth in this business.” The global subsidiary coverage team is responsible for developing multinational client portfolios across all markets in APAC. The clients covered by this group are regional treasury centres and subsidiaries of corporates and non-bank financial institutions that are headquartered in the Americas, Europe and Asia.

Chinese banks' improved asset quality cannot hide other phantoms

Robust economic growth and, especially, higher industrial prices have pushed up Chinese corporates’ profits since 2016. This comes as an upturn after a horrible 2015. Indirectly, this has also helped banks as it has increased companies’ cash flows to repay their large debt burden. However, this improvement in asset quality cannot mask other growing concerns in China’s banking sector.

HSBC unveils new one-stop mobile collections service in China

Chinese retailers can now collect payments from customers with e-wallets. HSBC became the first foreign bank in China to offer an omni-channel collections service that allows retailers in China to collect payments from customers who are using popular e-wallets such as Alipay, WeChat Pay, Apple Pay, and UnionPay. The new service operates across all major digital channels and can be applied at e-commerce websites, social media channels, and in-store transactions. It is also integrated with the existing China UnionPay (CUP) cards network and internet banking interface. The launch of the comprehensive collection service in China is a move to help multinational and domestic companies tap into a market where almost half a billion consumers use their mobile phones to pay for goods and services. With both urban and rural consumers increasingly relying on smartphones for shopping, playing online games, paying bills, and even managing their finances, China is the world’s leading mobile payment market. In 2016, the value of mobile payments jumped 46% from a year ago to reach RMB157.55t (US$23.8t), according to China’s central bank. Nearly 80% of Chinese smartphone users will be tapping, scanning and swiping to make payments throughout the country by 2021, research consultancy eMarketer estimates. By comparison, the US will have 31% of users doing so, whilst Germany will have 23%. Kee Joo Wong, head of global liquidity and cash management for Asia Pacific at HSBC said, “In China, mobile payments are increasingly essential to daily life, and have become a catalyst for businesses to engage in multi-channel retail activities. Given this backdrop, companies - in particular consumer-facing multinationals - recognise the payment preferences of their customers and are now giving them the flexibility to choose how, where, and when to pay.” However, the diversity of digital payment methods in China is also a challenge for retailers, in particular multinational companies new to the market who have to invest significant resources to connect with individual service providers in the absence of a one-stop solution for retail collections. With this omni-channel collections solution, HSBC not only helps retailers gather various e-wallet payments but also provides them with a consolidated view of their collections from all modes of payments, both traditional and digital. This eliminates the complexity of relying on multiple connections, thus reducing operational costs and building sustainable efficiency into retailers’ collections processes. “Our initiative in China is part of our global effort to improve our clients’ experience by adding value through digital transformation and innovation. In meeting our client’s evolving needs, our one-stop collections solution can further strengthen our receivables product suite, covering clients’ value chain needs by providing convenience, speed, and simplicity,” Kee Joo said. In China, HSBC is committed to developments in the digital space, to meet its clients’ changing business requirements. Recently, HSBC China joined the Internet Bank Payment System (IBPS), a domestic real-time payment system that will provide corporate and individual customers with an efficient and convenient channel for small-value payments.

ABN AMRO names Simon Dodd as Asia Pacific head of project finance and Greater China country executive

He joins from Intesa Saopaolo S.p.A. where he was chief executive for Hong Kong and the APAC general manager for the last ten years. Simon has expertise in advisory, structuring and arranging roles in sectors highly complementary with ABN AMRO’s focus in energy, commodities, food, transport & logistics, and financial institutions. Prior to Intesa Saopaolo, Simon worked with Bank of America in Hong Kong following senior roles across Australia, USA, and Vietnam where he opened Bank of America’s Hanoi branch in 1994. Prior to his move to banking, Simon was a research and exploration geologist in the mining industry for five years. Maureen DeRooij, CEO APAC at ABN AMRO says, “We are very pleased to have found a leader of Simon’s calibre who can accelerate the momentum we have in the industries we focus on and enhance the product capabilities we offer.” ABN AMRO strengthened its Greater China presence when it reopened its Shanghai branch in March 2016 enabling the bank to better support its corporate clients around the region with links to Asia’s largest economy. In APAC, ABN AMRO has offices in Singapore, Hong Kong, Shanghai, Sydney, and Tokyo. Other senior APAC appointments this year are similarly focused on ABN AMRO Bank’s Corporate and Institutional Banking business’ reputation as a relationship-driven sector bank providing tailored financing solutions and advisory to enable clients to access global opportunities. These include Simon Wood, head of financial institutions group APAC, who is building the bank’s proposition with financial institutions, and Peter Davis, executive director APAC, overseeing clients with commercial interests in Australia.

Outlook for Chinese banks 'stable' through 2018: Moody's

Thanks to strengthening government regulations and stable economic growth.

Chinese banks must watch out for this hidden hazard

A mortgage fraud frenzy could spell disaster for banks, says Reuters.

Chart of the Week: Chinese banks' NIMs to expand in the coming quarters

The big state-owned banks' NIMs stood at 2.1% in Q3.

Tighter regulatory scrutiny drags down Chinese banks' profitability

Chinese banks must brace for net interest margin pressures and declining profitability in 2018.

Why the slowdown in China's shadow banking is not as good as it seems

The borrowing is just moving around.

Here's why the new rules on foreign majority ownership in the financial sector is a boon for China banks

Its effect will be more pronounced amongst smaller financial institutions.

China's big four banks hit double-digit net interest income growth

BOC registered the biggest growth at 16.1% in Q3.

Chinese banks' profitability expected to improve over the coming quarters

Thanks to expanding NIMs and slowing NPLs.

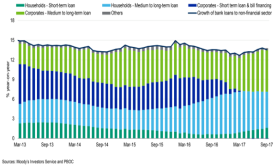

Chart of the Week: China's consumer loans on the rise

The steady increase caught the regulators' attention.

Why Chinese shadow banking activity stopped growing in 1H17

Nominal GDP also grew faster than shadow banking assets.

Chart of the Week: China banks' asset growth slows in 1H17

Growth decelerated to 4.4% in the first half of the year.

China's big banks post higher profits and slower bad loans growth in Q3

Thanks to a 'cocktail of policy measures'.

Chinese banks' 1H17 asset growth significantly slower than in the past decade

Assets grew by only 4.4%.

Advertise

Advertise