China

Why smaller Chinese banks are more vulnerable to wholesale funding withdrawal

Interbank transactions as a share of total funding increased to 12%.

Why smaller Chinese banks are more vulnerable to wholesale funding withdrawal

Interbank transactions as a share of total funding increased to 12%.

What you need to know about 'ghost collaterals' haunting Chinese banks

These fraudulent collaterals endanger the health of China's financial system.

China to intensify crackdown on shadow banking sector as credit risk rises

Regulators have already used administrative methods to control credit growth.

Chinese banks' average annual loan growth to hit 7% till 2020

Client loans could reach US$18.7t in 2017.

Smaller banks to suffer from China's deleveraging efforts

These banks could be forced to cut dividends.

China banks' NPL ratio flat at 1.74% in Q1

Asset quality has largely stabilised.

Large state-owned banks in China conservative in recognising NPLs

But NPL formation has moderated since 2H16.

Chart of the Week: Chinese banks' NPLs hit US$219b in 2016

It increased 18.7% year-on-year.

JPMorgan unveils virtual branch in China

It's the fourth location globally where it has been rolled out. According to a release by JPMorgan, the service eliminates the need to be physically present at traditional bank branches, reduces manual interventions and improves turnaround times through faster and more efficient transaction processing. “Integrated within our J.P. Morgan ACCESS OnlineSM portal, which was recently named the top-ranking cash management portal globally by Greenwich Associates, the Virtual Branch allows clients to upload, check and store their supporting documents electronically,” said Rani Gu, Head of Treasury Services, China, and Head of Treasury Services Product, Greater China, J.P. Morgan. “The portal’s sophisticated Dashboard offers track-and-trace capabilities, which allows clients to check and monitor the end-to-end workflow progress of all their cross-border merchandize trade transactions, within a cohesive platform. Email alerts can also be activated to ensure our clients receive instant status updates of all their documentation processes, directly to their mailbox,” she added. The launch follows the successful introduction of J.P. Morgan’s Virtual Branch in India, Indonesia and Thailand. The number of clients in these countries using the service has been growing rapidly and the bank is expecting strong interest in China as well. “China is a huge market with increasing cash management demand and J.P. Morgan is well positioned to be a contributor as a leading treasury services provider in the world during Chinese companies’ globalization. We are confident that this new platform will further help us better and more efficiently serve our clients in this market,” Gu added. J.P. Morgan continues to invest heavily in technology; in 2016, the bank spent $9.5 billion in technology firm-wide, of which approximately $3 billion was dedicated toward new initiatives. By 2017, the firm’s Treasury Services business is expected to increase its technology budget by 12% versus 2014, with investments that include block-chain, big data, cloud computing, robotics and machine learning. “As a leader in cash management technology and the digitization of treasury solutions, J.P. Morgan is committed to developing innovative products to improve efficiencies in the way clients operate their businesses,” said Gu.

China regulator launches emergency risk assessments for banks' lending practices

It will include the banks' issuances of negotiable certificate of deposits.

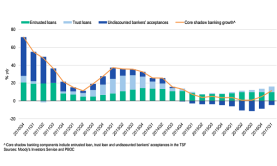

Chart of the Week: Core shadow banking activities in China rebound in Q1

That is after slowing to a near stall in 2016.

Risks rise as Chinese lenders ditch struggling corporates for retail borrowers

The switch is fuelling an unusual jump in home loans.

How does the tight systemic liquidity affect China's shadow banking sector?

Stricter regulations aim to constrain the growth of leverage in the country.

HSBC sees less customer footfall in Pearl River Delta branches

Find out why HSBC still has a mountain to climb.

Chinese regulators to increase scrutiny of the shadow banking sector

These new measures are likely to be negative for corporate bonds.

China Construction Bank's deposits up 5.4% to US$2.3t in Q1

Loans also rose 3.5% in the same quarter.

Why Q1 was only the beginning of a 'divergence' in China's banking sector

Weak franchise banks greatly underperformed during the quarter.

Advertise

Advertise