China

China's big banks turn to short-term financing to offset deposit woes

Issuance of negotiable certificates of deposit ballooned to $68b in Q1.

China's big banks turn to short-term financing to offset deposit woes

Issuance of negotiable certificates of deposit ballooned to $68b in Q1.

Global asset managers in China: Opportunities arising from structural reform

This is now an inflection point for foreign asset managers as China vows to allow foreign players to take controlling stakes and operate domestically in the private securities fund management (PFM) and even mutual fund management markets.

China Construction Bank's profit rose 9% to $6.5b in Q4

Net interest margin expanded 2.36% as credit card loans and consumption loans performed strongly.

Chart of the Week: Here's a historical look at China's domestic banking assets

Claims on the corporate sector represent 36% of loans.

China's big banks profits surge 4.9% to $30.5b in 2017

ICBC, CCB, and Agricultural Bank of China all posted improved profitability.

China banks expand household lending and wealth management business

Bank lending to households represent half of GDP and 82% of disposable income in 2017.

China banks poised for profit as combined net income to rise 8% in 2018

A recovering domestic economy is boosting loan demand.

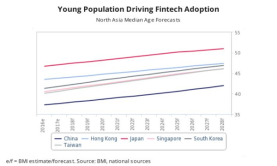

Chart of the Week: Here's how the younger generation in China pushes fintech growth

They are likely to help the continued penetration and popularity of e-payment systems.

China bank's medium-term loans up to $155.06b in February

The country's deleveraging campaign boosted return of funding demand to on-balance sheets.

China banks are the sixth largest creditor group globally

Its cross border financial assets was valued at US$2t in Q3.

China's “matryoshka” approach for debt-to-equity swaps could be good for banks, but bad for investors

Chinese banks seem to have made meaningful progress in the resolution of problem loans. The aggregate amount of the announced debt-to-equity (D/E) swaps has reached 1 RMB trillion, to 19.5% of problem loans by the end of 2017. However, words are louder than actions as only 15.7% of the total announced D/E swaps have been executed. Banks clearly need to move faster in their cleanup and Chinese regulators are not only aware but also increasingly supportive. To this end, the big five banks have established their own asset management companies (AMCs) to help carry out debt-to- equity swaps. The way in which banks and their asset management companies will operate for the loan cleanup was clarified in a new guideline jointly published by regulators last January.

China eases banks' bad-loan coverage ratio to 120%

The lower non-performing loan rules will allow banks to extend more credit.

China $7b shadow banking industry threatens economic stability: FSB

Shadow lenders in the country account for about 15% of global high-risk non-bank loans.

China banks' regulator revises rules for foreign banks and investment

The move aims to further open the country’s banking sector.

China banks' asset growth dips to 7% amidst tighter regulations

The slowdown is a welcome development as risks particularly in shadow banking are reduced.

China Construction Bank targets 7.1% loan growth in 2018

This will be driven by infrastructure loans, residential mortgages, and personal consumption loans.

UOB adds forex solutions in China to support trade finance needs

One of the solutions enables direct RMB and Thai baht trade.

Advertise

Advertise