In Focus

Will the fintech revolution threaten underspending Malaysian lenders?

Alibaba and Tencent, which command significant e-payments market share, could pose a big challenge.

Will the fintech revolution threaten underspending Malaysian lenders?

Alibaba and Tencent, which command significant e-payments market share, could pose a big challenge.

Will regional bank distress threaten China's fragile financial stability?

Failure at the regional level may squeeze funding options for the NBFI sector.

For better or worse: Chinese banks court risk in deepening ties with insurers

Insurers are lining up to snap up perpetual bonds, with $32.14b of such instruments already hitting the market.

Banks into hubs: OCBC NISP embraces guesthouse-feel branches

Select outlets draw on a mix of batik and contemporary aesthetic and feature special aromatherapies.

Virtual banks threaten to take a bite out of Hong Kong's small players

Banks can expect fiercer competition on the lending and deposit fronts.

Virtual bank data scientists are driving hiring in Hong Kong

Employers are seeking data scientists and full stack developers for mobile and web applications that go beyond the traditional set of tech skills.

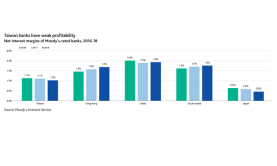

Internet-only banks threaten to wipe out Taiwanese bank earnings

Lenders already have margins that fall behind that of Hong Kong, China and South Korea.

How Thai banks are breaking the branch mold

Krungthai Bank is looking to launch five more retail-like branch formats in 2019.

Singapore's fintech invasion has no end in sight

About 43% of fintechs in Southeast Asia choose Singapore as their home amidst strengthening growth prospects.

Hong Kong lenders shrug off virtual banking threat

Account fees, which were waived, represent only a negligible income source.

China's shadow banking assets fall to two-year low in Q1 even as crackdown eases

Core shadow banking activities have dropped to $420b in 2018.

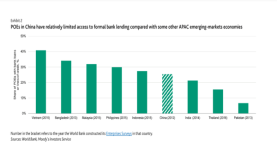

Which Asian banks have the freest credit line for POEs?

China is lagging behind with share of POE bank loans just at 26%.

China's first bank seizure in decades highlights growing small bank risk

State-owned CCB will ba taking over the business of Baoshang Bank.

Virtual cash management tools are taking off in Asia

Global transaction banking revenues are estimated at nearly $1t in 2017 or 43% of wholesale banking revenues.

Asset quality risks grow as Taiwanese banks grapple with China's slowdown

Delinquencies climbed in the overseas loans of cyclical sectors as well as loans to China and Southeast Asia.

Banks caught in Beijing's risky balancing act as second largest economy stutters

The People’s Bank of China has launched a Central Bank Bill Swap to help banks actively lend more. Two months after the world’s second-largest economy posted its slowest growth pace since 1990, Beijing has stepped up its support for the banking sector, highlighting its key role in the government’s plan to sustain the pace of expansion. However, smaller banks will likely face a trying 2019 despite the slew of measures meant to expand capital access and bolster profits. Unlike the goliaths of the banking sector, smaller banks will feel the squeeze on all sides, from the aftershock of the government’s deleveraging drive to the current push to boost lending as a way to support the slowing economy. Larger state-owned banks are relatively more insulated from the current industry pressures compared to smaller private banks, which are more exposed in terms of weaker loan quality, funding concerns and diminished access to both internal and external capital, according to Andrew Wong, vice president, credit research at OCBC, as they enjoy better access to higher-quality borrowers and a robust funding stream via deposit franchises and capital market access. China’s economy grew at a slower annual pace of 6.6% in 2018 and Beijing has targeted a more modest expansion of between 6-6.5% in 2019 amidst a turbulent geopolitical backdrop marked by trade tensions with the US With the decelerating economy weakening the ability of businesses to repay debt, the NPL ratio of Chinese commercial banks climbed to a 10-year high of 1.89%, said Liu Zhiqing, deputy head of the statistics department of the China Banking and Insurance Regulatory Commission (CBIRC), according to a Reuters report. “Banks will need to remain alert to these dynamics too and monitor their risk profile through stringent underwriting,” added Wong. “Higher-than-expected loan losses will be more detrimental to earnings and capital generation in this slower growth and tighter funding environment.” Banks will also need to make full use of the perpetual bond issuance policies and other measures that may be rolled out in a bid to ease capital constraint, he said. In January, the People’s Bank of China launched Central Bank Bills Swap (CBS) to support perpetual bond issuance, which the central bank reckoned will help banks replenish their capital and be in a stronger position to support the broader economy through their lending operations. “We see the action is credit-positive for banks’ depositors and senior debt holders because the swap facility will increase the attractiveness of bank-issued perpetual bonds to participating investors and support banks’ efforts to strengthen capital,” said Ray Heung, senior vice present at Moody’s Investors Service. The CBS scheme functions as a policy aid for banks to achieve the ambitious administrative target on lending to the private sector and expand their balance sheets accordingly, said Alicia Garcia Herrero, chief economist at Natixis.

Singapore banks set for Q1 profit boost as corporate loans and wealth income recover

Trading and wealth management income may have rebounded between 10-36% in Q1.

Advertise

Advertise