In Focus

Chinese banks post loan recovery in March, but further growth unlikely

A fiscal stimulus is needed to spur demand.

Chinese banks post loan recovery in March, but further growth unlikely

A fiscal stimulus is needed to spur demand.

Hong Kong banks' asset quality battered by COVID-19 and protests

Exodus of corporate clients, mortgage risks, and dropping credit card use pose a big threat on revenues.

Philippine banks' asset quality face decay amidst region-wide lockdown

The monetary board’s 50bp policy cut will put additional pressure on NIMs.

Credit card revenues threatened as Singaporean travellers shun usage

Card users turn to cash as they steer clear of lofty transaction fees and poor exchange rates.

Data and automation will help Hong Kong banks survive until the next decade

Emerging technology and customer data will help banks weather low interest rates and new competition.

Tokyo is banking on foreign fintechs to reinvigorate its financial sector

Fintechs may tap into US$9.07t (¥984t) of individual cash sitting in banks, says the Tokyo Metropolitan Government.

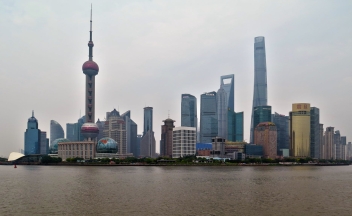

ASEAN supply chain shifts a win for Singapore banks

They will be attracted to the banks’ strong balance sheets and access to USD funding.

Future Ready: How can banks build a checkmate-proof IT strategy in 2020?

Heavy investments in technology will mean nothing without investing in manpower, according to experts.

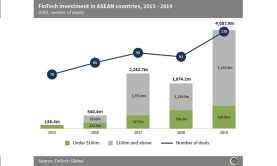

ASEAN fintech investments hit $8.9b from 2015-2019

This represents a CAGR of 133.1%.

How KBZ Bank strides towards financial inclusion in Myanmar

They launched mobile wallet KBZPay, banking on the country's high smartphone penetration to improve financial connectivity.

How banks can win in a rapidly shifting global payments arena

Incumbents are building up capabilities and forging partnerships with former foes to stay competitive.

APAC finance firms adapt defensive stance for 2020

Geopolitical and macroeconomic risks threaten the sector’s overall credit profiles.

ASEAN banks lack progress in green finance

Only 62% of banks have assigned sustainability strategy to senior management.

How foreign fintechs will buoy Japan's banking sector

They might introduce new business models and solve overcapacity, says a former central bank deputy governor.

Singapore banks could grapple with falling interest margins in 2020

An easing monetary policy and slow loan growth are dragging on NIMs.

Singapore bank headcounts rise with tech talent boosting numbers

Banking staff at Singapore’s 18 largest commercial banks grew 5.47% in the last two years.

Cards to reign supreme in South Korea as cash loses appeal

By 2020, cards will emerge as the dominant payment instrument.

Advertise

Advertise