Exclusive

Will RMB soon beat USD as the main currency for cross border trade?

The internationalisation of RMB is providing banks with opportunities to enhance their cash management structures in the face of a USD liquidity shortage - but does a shortage really exist till now?

Will RMB soon beat USD as the main currency for cross border trade?

The internationalisation of RMB is providing banks with opportunities to enhance their cash management structures in the face of a USD liquidity shortage - but does a shortage really exist till now?

Here’s what Asian banks need to know about FATCA

We already know the huge impact, if not burden, the proposed FATCA regulations brings to Asian banks - but what else do we need to know about the new regulation? KPMG, Deloitte and PwC give their insights.

Why are Chinese enterprises net withdrawing money?

Could it be that they are keeping their money elsewhere - perhaps in CNY accounts in Hong Kong?.

Integration of cash and trade key for greater efficiency in Asian banks

As clients look for enhanced services, banks will have to strive for better cash and trade product sets - find out what HSBC’s John Laurens, Citi’s Ravi Saxena, and DBS’ Ken Stratton have to say.

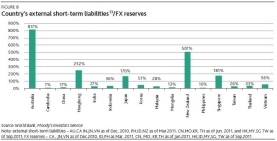

Government limitations to provide liquidity for AsiaPac banks

Floating exchange rate regimes in Asia Pacific countries give governments flexibility to provide liquidity support to the banks, but not in Hong Kong.

Asian banks to be mired in FATCA’s worrisome regulations

Asian banks will have to brace for financial concerns, operational burden, and data privacy dilemmas brought about by FATCA - but these are not the only challenges.

Asia to face regulatory scrutiny in payments

Increased pricing pressure, cost complexities, and western regulatory initiatives may have custodians worried.

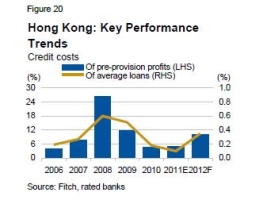

Graph of the Week: Higher credit costs to hit Hong Kong in 2012

Blame it on lower global economic activity, weakening domestic property markets, and higher inflation.

Worries over funding costs in Hong Kong loom in 2012

Given the challenges in credit growth and deposit, Fitch warns of some increase in funding costs.

FATCA set to be a burden to Asian banks

As the US pushes for stricter regulations to avoid tax evasion, Asian banks are forced to follow implementation and remediation requirements by 2015 - find out what analysts from Deloitte, PwC, KPMG, and Ernst & Young have to say.

Will OTC derivatives clearing in Asia mirror the US and EU model?

Standard Chartered’s Giles Elliot says it will surely have a big impact in the market, though not all players can afford the capital charges for extensive memberships in different markets.

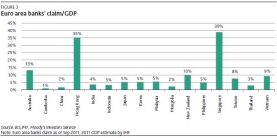

Graph of the Week: AsiaPac banks’ exposure to the EU crisis

Singapore and Hong Kong will be the hardest hit should euro area banks retreat.

Regulation and tax pressures to hit the securities industry in 2012

HSBC and Standard Chartered concur that banks in Asia will have to brace for a depth of regulatory change and evolution of tax regimes this year.

ATM makers hope to squeeze cash out of system

New software even plans out more efficient truck delivery routes.

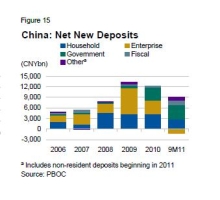

Graph of the Week: China's dwindling deposits

China’s deposits are slowing down which may force banks to raise more money.

Deposit woes continue to haunt China’s banking sector

In a recent teleconference, Fitch analyst Charlene Chu warned earnings growth is not strong enough and banks will be forced to raise equity.

Advertise

Advertise