Exclusive

What you need to know about ANZ's Cashactive Fusion

Time to say goodbye to spreadsheets and emails as ANZ aims to automate organisations' financial information to enhance cash flow forecasting.

What you need to know about ANZ's Cashactive Fusion

Time to say goodbye to spreadsheets and emails as ANZ aims to automate organisations' financial information to enhance cash flow forecasting.

SMEs still prefer conventional FX risk management

But bankers say that those with higher FX volumes could conduct such activity online.

How will foreign banks' local incorporation affect Singapore's banking industry?

Foreign banks are now forced to decide whether to further commit to the Singaporean market and compete with domestic banks neck-to-neck, says ADB.

Australian banks may fail to finance massive infrastructure shortfall

With a shortfall of up to A$770 billion this decade, infrastructure as an asset class for investors remains problematic.

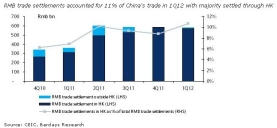

RMB trade settlements settled through HK

Eleven percent of China's trade in 1Q12 were RMB trade settlements that were mostly settled through Hong Kong.

Will China continue to benefit from Europe's financial turmoil?

Reports say that Chinese banks grabbed a third of global banking profits in 2011 as European banks retrench - but will this last?

More hedging solutions for Asian banks revealed

As various services and products emerge across Asia and trade is settled in different currencies, we sought the insights of bankers and analysts for possible hedging solutions.

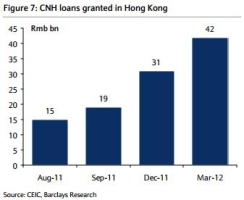

CNH loans granted in Hong Kong reaches RMB 42b

The 3-5% CNH lending rates in Hong Kong still prove to be more attractive than CNY lending rates in China.

Local currencies slowly becoming a substitute for G3 currencies?

Bankers believe local currencies are getting more important, but warns that their potential highly depends on the economic and trade positions it commands in the global arena.

Is Islamic finance moving towards Skype banking?

Branches can still remain the main delivery channel for Islamic banking, but CIMB warns that regulators must also know how to regulate things such as Skype and Facebook banking.

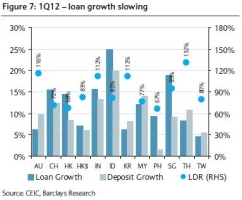

Loan growth in Asia slows in 1Q12

Eight of twelve banking markets across the region saw decelerating loan growth which caused improving funding gaps in Asia.

J.P. Morgan's Michael Sugirin to embrace a 'culture of change'

"As the Indonesian market continues to grow in stature and global presence, those who innovate will emerge at the top of the pile," says JP Morgan's new head of treasury services.

Competition for deposits heats up in Asia

Find out how banks wage war for deposits in Singapore, South Korea, Hong Kong, and Indonesia.

What keeps Singapore banks the world’s strongest?

Reports say that OCBC, UOB, and DBS lead Bloomberg’s ranking of the world’s strongest banks - what could be the key to their success?

“There will not be any uniformity of application of Shariah”: CIMB

But the former CEO of Kuwait International Bank argues that standardization of global Islamic banking suite of products and services will lead to more uniform Shariah compliance over time.

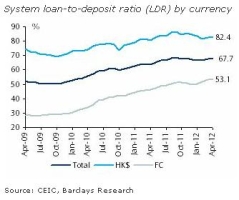

Hong Kong banks' loan-to-deposit ratios remain elevated

Foreign currency LDR remained high at 53.1%, on the back of US$- and CNH-denominated loan demand, says Barclays.

Credit slowdown lingers in China

China's lending and deposit rates remain stable, while outstanding loans still show a downtrend.

Advertise

Advertise