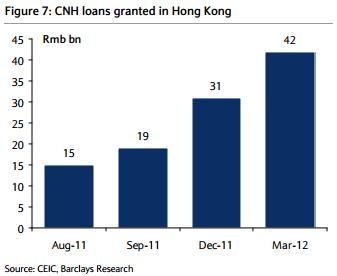

CNH loans granted in Hong Kong reaches RMB 42b

The 3-5% CNH lending rates in Hong Kong still prove to be more attractive than CNY lending rates in China.

According to Barclays research, the improvement in the deployment of CNH assets especially in loans has resulted in growing CNH deposit competition between the Hong Kong banks in order to fund asset growth. CNH loans reached RMB42bn in March 2012 (+36% q/q). Dim sum bond issuance amounted to RMB52bn YTD June 12, flat y/y on an annualised basis.

"Customers are more willing to borrow in CNH since it is no longer expected to appreciate. Moreover, CNH lending rates in Hong Kong (3-5%) are still more attractive than CNY lending rates in China (5-7%). However, the lengthier process and government approvals that need to be obtained in order to repatriate funds to China are still a deterrent for some corporates against borrowing in CNH or issuing dim sum bonds," it said.

Advertise

Advertise