Government limitations to provide liquidity for AsiaPac banks

Floating exchange rate regimes in Asia Pacific countries give governments flexibility to provide liquidity support to the banks, but not in Hong Kong.

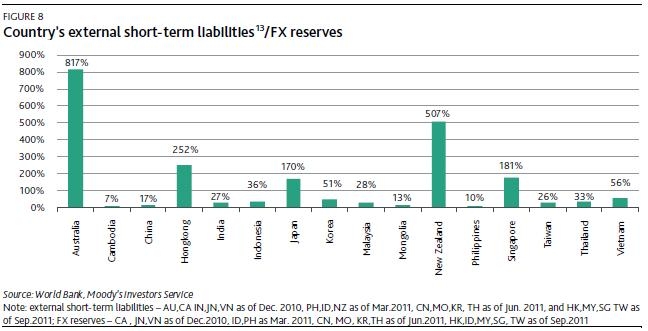

To assess a government’s capacity to provide liquidity for banks in a euro area crisis if needed, Moody's considered the government’s access to financial resources, as measured by two liabilities-to-FX reserves ratios.

According to Moody's Investor Service, "Australia, New Zealand, Hong Kong, Singapore and Japan have large short-term liabilities relative to their FX reserves. However, most of these countries – excluding Hong Kong – adopt floating exchange rate regimes, which give their governments the potential flexibility to provide liquidity support to their systems. Despite Hong Kong’s substantial FX reserves holdings, its ability to provide liquidity is constrained by the currency board mechanism."

Graph from Moody's Investor Service: Assessing the Exposure of Asia Pacific Banks to the Risk of Deterioration in the Euro Area

Advertise

Advertise