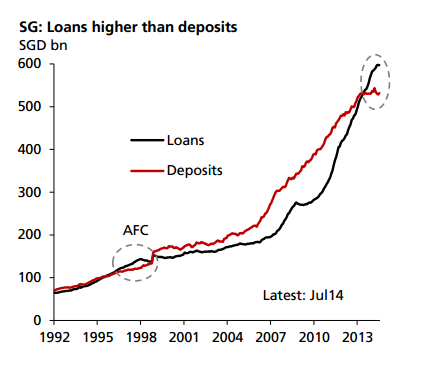

Take a look at how Singapore’s loan growth is nearing the peak of the 1997 Asian financial crisis

Deposit growth languishes near to zero.

The gap between loan and deposit growth figures will remain wide. Both figures will be announced today and loan growth should remain around 10% level while deposit growth is likely to languish near to zero. This is more or less unchanged from 10.8% and -0.01% respectively in July.

According to DBS, with the gap between loan and deposit growth expected to remain wide, total loan value will continue to stay above deposit value (see Chart). This implies that the loan to deposit ratio will continue to stay above parity and could possibly approach the historical peak of 1.17 recorded during the Asian financial crisis in the coming months.

DBS adds that the Monetary Authority of Singapore introduced the Total Debt Servicing Ratio (TDSR) in June last year in a bid to contain the rapid increase in household leverage. And this coincides with the loan to deposit ratio hitting parity in the same month. So, as long as the loan to deposit ratio remains elevated and global interest rates remain low, it is unlikely that the authority will unwind on the property market cooling measures introduced in recent years.

Advertise

Advertise