Photo by Naveed Ahmed via Unsplash.

Photo by Naveed Ahmed via Unsplash.

Indian banks’ net interest margin decline as deposit costs rise

Deposit costs rose by up to 90 basis points for some banks.

The net interest income (NII) of select scheduled commercial banks (SCBs) in India grew 9.7% year-on-year (YoY) in Q1 FY2025 (April to June 2024), according to data from CareEdge Ratings.

Healthy credit growth was partially offset by a rise in deposit costs and a dip in yield advances, the ratings agency said in a report.

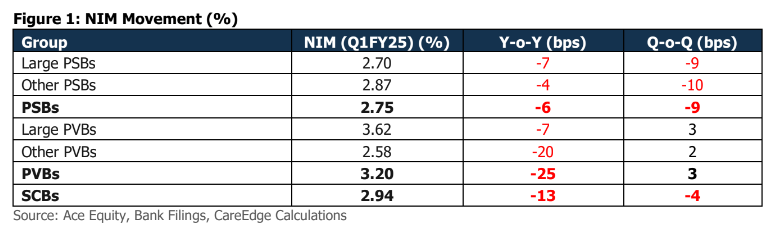

However, net interest margins (NIM) dropped 13 basis points (bps) to 2.94% in Q1 compared to Q1 FY2024 on the back of slower growth in CASA and rising cost of deposits.

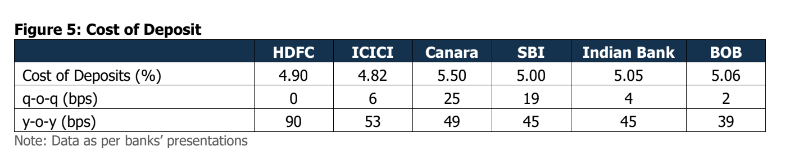

SCBs’ deposits grew 13.7% YoY during the quarter. Cost of deposits in 6 Indian banks rose between 39 bps to 90 bps in the April to June 2024 period.

In the coming quarters, credit growth is expected to train deposit growth, according to CareEdge Ratings.

“Thus, intensified deposit competition will lead to further straining of NIM in upcoming quarters as interest rate competition persists,” CareEdge Ratings said.

Advertise

Advertise