China's city commercial banks growing faster than their larger peers

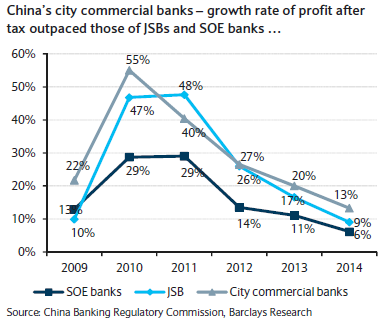

Profits after tax grew by 13%, outpacing SOE banks' 6% growth.

According to Barclays, city commercial banks (Chongqing Rural Commercial Bank, Bank of Chongqing, Shengjing Bank, Huishang Bank) developed quickly since they were established and are still growing at a pace faster than their larger peers. The data released by the China Banking Regulatory Commission (CBRC) reveals that as of end-2014, there were 133 city commercial banks in China with combined total assets of RMB18tn – which is 4.5 times the total in 2008 and already accounting for 10% of the system total, compared with only 7% in 2008.

In recent years, more and more city commercial banks have raised capital in Hong Kong as listing on China’s domestic stock exchanges usually takes much longer, notes Barclays. Since CRCB listed on the Hong Kong Stock Exchange in December 2010, a total of eight city commercial banks have gone public in Hong Kong, raising US$7.6bn through end-2015.

"Despite the macroeconomic slowdown across China in recent years and the restart of interest rate deregulation in 2012, city commercial banks have delivered stronger results vs. SOE banks and JSBs since 2013. As shown in the graph, the CBRC data show that city commercial banks’ profits after tax grew by 13% y/y in 2014, outpacing the rates of 9% registered by JSBs and 6% for SOE banks."

"The stronger set of results for the city commercial banks was mainly due to their faster revenue growth as well as milder asset quality deterioration as data revealed by the listed city commercial banks. The faster revenue ispartially driven by higher asset expansion through maintaining leverage ratio, offsetting slight narrowing ROA since 2012 (in contrast to SOE banks’ stable ROAs but significant decline of leverage, and JSB’s compression of both ROA and leverage," adds Barclays.

Advertise

Advertise