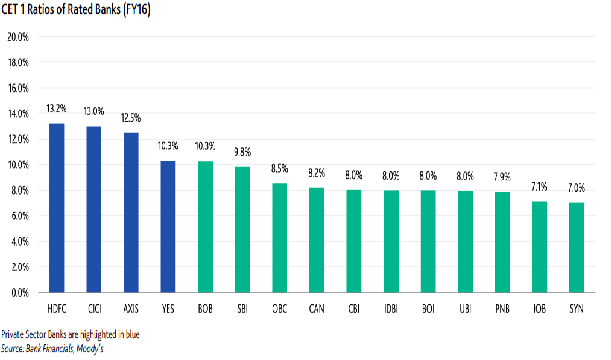

Chart of the Week: Weak capital levels of India's state-owned banks a key credit constraint

Moody's suggests slowing loan growth to single digits to bridge the capital shortfall.

According to Moody's Investors Service, Indian banks' capital strength will continue to show divergence between the weak public banks and the far stronger private banks.

Here's more from Moody's:

State-owned banks will require significant external infusions of equity capital over the next three years. However, they have not been able to demonstrate access to the equity capital markets, while the announced capital infusion plans of the government fall short of the amount required for full recapitalization. A potential way to bridge this capital shortfall would be to slow loan growth to the low single digits over the next three years.

In contrast, while some private banks would also be burdened by deteriorating asset quality over the next 12-18 months, their high starting levels of capital – as well as high core profitability – will help them preserve their current high capital levels.

Advertise

Advertise