Chart of the Week: Loan re-pricing boosts Singapore banks' interest income

The net interest income of DBS and UOB may rise 9.3% and 7.4%.

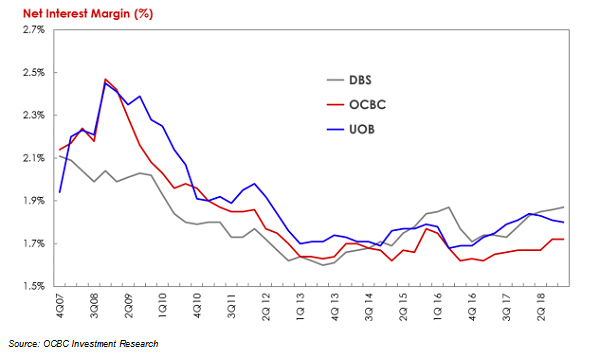

As the net interest margin (NIMs) of Singapore banks widen in the coming months, lenders may cash in on higher interest income brought about by the re-pricing of loans which have already started in late 2018, according to OCBC Investment Research.

NIMs, a common measure of profitability, ranged from 1.72-1.87% in Q4 2018 after hitting a low in late 2016, with headline figures set for further upside. Based on the SIBOR one-month rate, rates have been trending up from 1.517% in September 2018 to 1.763% at end-2018.

DBS outperformed the other two with its NIM widening 9 basis points in 2018, compared with 5 basis points increase for OCBC, and 1 basis point decline for UOB, data from Moody's show.

Also read: Singapore banks turn to loans to boost earnings as wealth income weakens

"We expect this to be positive for the banks, especially in terms of interest income. We are projecting a 9.3% rise in net interest income for DBS and a 7.4% rise for UOB in FY19. As a result, we expect the Net Interest Income to account for 68% of total revenue in FY19, up from 63-64% in FY16 and FY17," analyst Carmen Lee said in a report.

UOB is also set for a similar boost with net interest income set to form 68% of total revenue versus 62% in FY16 and FY17.

Advertise

Advertise