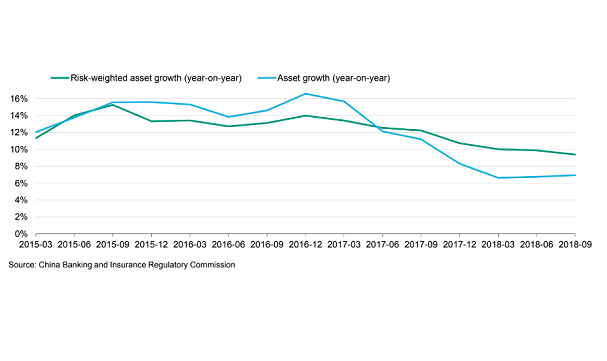

Chart of the Week: Chinese bank capital receives boost as asset growth slows

Banks have been shifting to on-balance sheet activities.

Chinese bank capital is set to remain stable over the coming months on the back of a slower growth in banking assets and strong internal capital-generation ability, according to Moody's Investors Service.

The sluggish growth of banking assets come as lenders shun shadow banking activities and embrace conventional and on-balance sheet activities in line with Beijing's deleveraging campaign.

Also read: China's shadow banking sector shrunk to $9.0t in January-September 2018

The expansion in Chinese banking assets plunged to single-digit growth for the first time in 10 years in 2017 as lending outpaced the growth in assets. From a high of 16.5% in 2016, asset growth dropped to 8.7% in 2017 and has continued trending downwards to 6.6% in Q1 2018 as lending picks up.

"Some banks will continue to experience fast loan growth partly as a result of the migration of off-balance sheet assets back to loans. These banks could be challenged in their capital management without external capital injections," noted Moody's.

The loan growth of Chinese commercial banks is expected to rise to 13.8% by end-2019 as the central bank charts a looser monetary policy to cushion the impact from the economic slowdown, data from Fitch Solutions show.

Advertise

Advertise