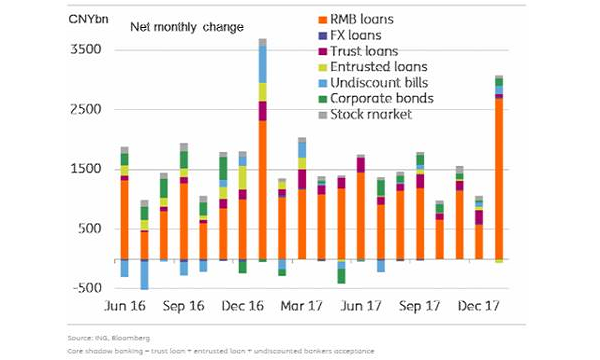

Chart of the Week: Check out how China's shadow banking items shrank in 2018

There was a 17% YoY reduction of total social financing.

China may have succeeded in reining shadow banking as data from the Chinese central bank show that core shadow banking items shrank in total social financing, a measure of standard banking plus shadow banking activities, ING Asia Pacific reports.

Here's more from ING Asia Pacific:

China's loan data shows that shadow banking is shrinking, this could be the result of financial deleveraging reform. We expect the reform to continue for the rest of 2018.

Loans going to standard channels, namely, new yuan loans grew 40% year-on-year to CNY2.69 trillion and contributed 87.9% of total social financing.

Even though banks are usually eager to book loans at the beginning of the year in order to enjoy a full year of interest income, it seems that financial regulators, including the central bank, the banking regulator, insurance regulator and the securities regulator, have gained some success in limiting shadow banking activities. New trust loans fell to CNY45.5 billion, and new entrusted loans contracted by CNY71.4 billion, which resulted in a 17%YoY reduction of total social financing.

Advertise

Advertise