Why you must not be fooled by Chinese banks' good 1H13 profit results

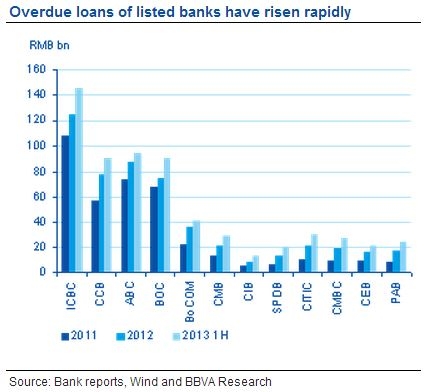

The sharp overdue loans increase suggest weak underlying trends.

BBVA Research notes that given the results, profit growth for 2013 is likely to exceed its previous 2% projection by a considerable margin.

However, despite the positive outturn, overdue loans rose sharply (see chart), suggesting that underlying financial trends may not be as strong as indicated by the profit results alone.

Here's more from BBVA:

There are signs of deteriorating asset quality. Although headline non-performing loans (NPLs) for listed banks rose only slightly, from 0.8% of total loans at end-2012 to 0.9% at present, “overdue loans” rose by 21.4% from end-2012, especially for medium-size banks that have a relatively higher exposure to smaller firms that are more susceptible to the economic slowdown.

Advertise

Advertise