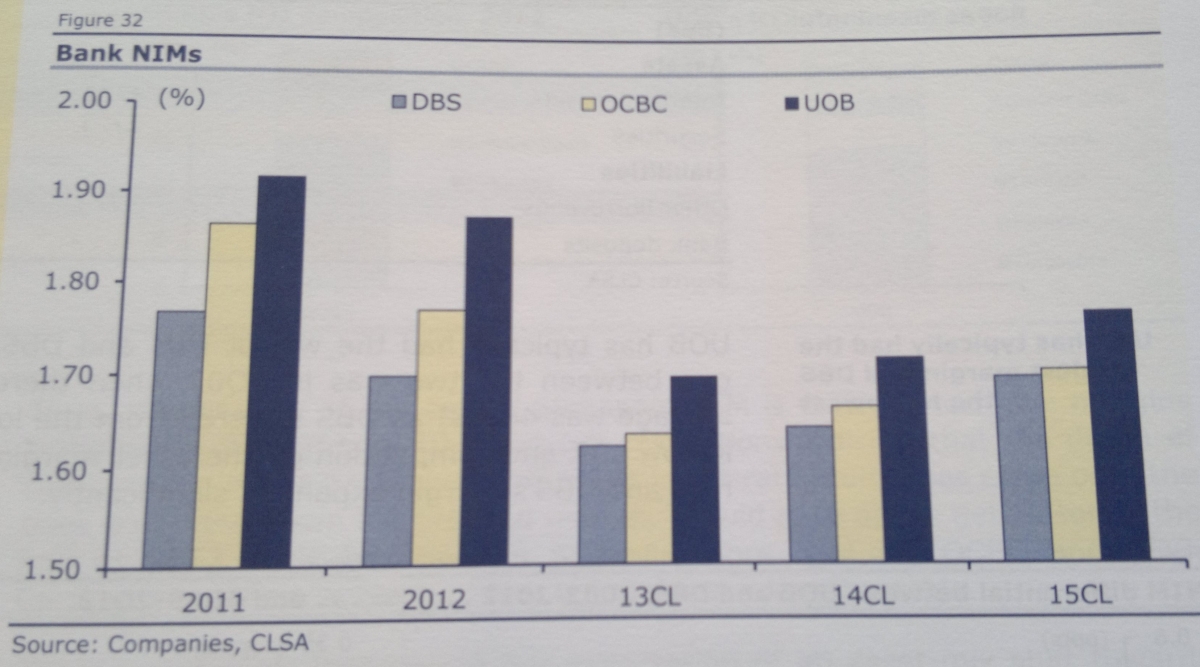

Why the NIM stabilisation in 2Q13 was an important inflection point for Singapore banks

It foreshadows steady structural recovery.

CLSA analyst Asheefa Sarangi is hopeful that the stabilisation in key profitablity drivers such as NIM is the beginning of a slow and steady structural recovery before the banks start to benefit from rising interest rates in 2015.

"The two most important levers for the banks' margins are loan book asset yield (72-81% of total asset yield) and deposit cost (75-84% of total funding costs)."

Sarangi also notes that though their outlook on Singapore banks may not be exciting, it is comforting, with broadly stable ROE through 2015.

Advertise

Advertise