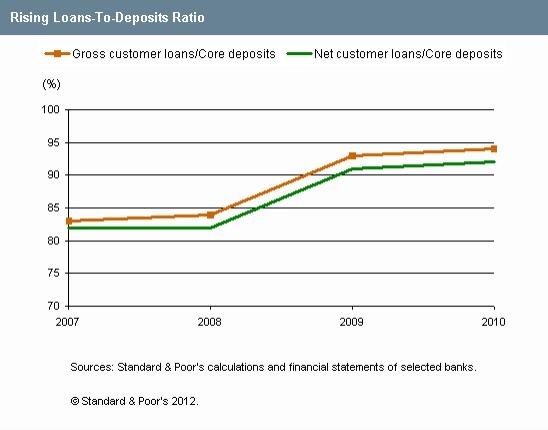

Vietnam's rising loans-to-deposits ratio

The pace of credit growth has outstripped the availability of funds since 2008, says Standard & Poor's.

According to S&P, Vietnam's banking system has been grappling with tight liquidity since 2008. The rapid pace of credit growth is reflected in the system's rising loans-to-deposits ratio. "The smaller and financially weaker banks typically bear the brunt of funding pressures because they lack the sophistication and wherewithal to handle a prolonged strain on liquidity. Instead, they rely on short-term measures and price wars to secure deposits, which have a destabilizing effect on funding and tend to erode margins."

Advertise

Advertise