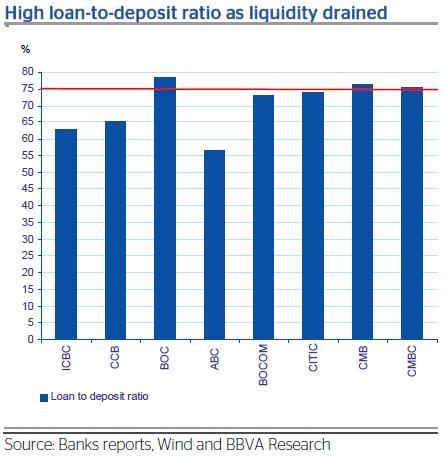

Cuts in required reserve ratios are not enough to fully offset the tighter liquidity conditions, says BBVA.

According to Le Xia, senior economist at BBVA Research, intensified external uncertainties, in particular from the European sovereign debt crisis, have resulted in lower capital inflows and tighter liquidity conditions in the banking sector.

"While the central bank can continue to implement supportive measures, such as further cuts in required reserve ratios (RRR), these may not be sufficient to offset fully the tighter liquidity conditions in the banking sector."

Join Asian Banking & Finance community

Since you're here...

...there are many ways you can work with us to advertise your company and connect to your customers. Our team can help you dight and create an advertising campaign, in print and digital, on this website and in print magazine.

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.

Let us help you drive your business forward with a good partnership!

Advertise

Advertise