Chart of the Week: Singapore banks to suffer from weak market-related income in 4Q14

Also, trade loans could fall faster than expected.

Analysts estimate that loans grew ~2% q/q in 4Q14, driven by corporate and non-housing retail loans.

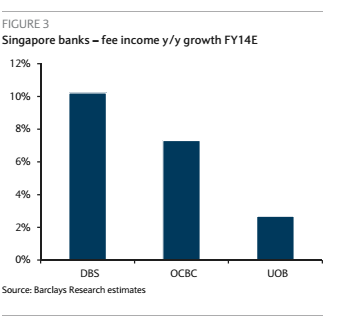

According to a report by Barclays, steady fee income is expected for banks as they continue to focus on fees in the low interest rate environment. However, the banks are likely going to be impacted by weaker market-related and trading income in 4Q.

Analysts forecast 10% fee income growth for FY15 driven by wealth management and client activity, but see downside risk on loan-related fees if trade loans fall faster than anticipated.

Advertise

Advertise