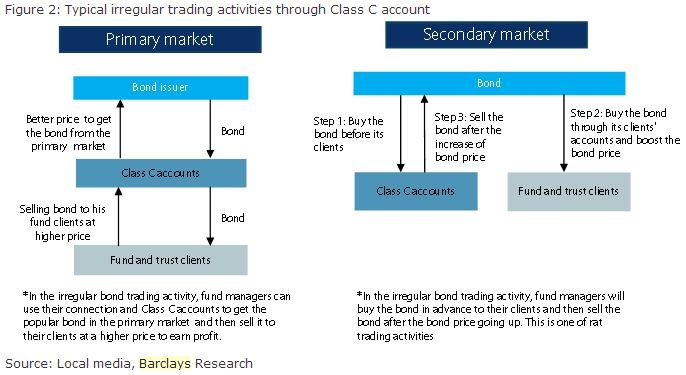

Beware of these typical irregular trading activities of Class C accounts

Regulatory tightening was already imposed in China.

According to Barclays, local media recently reported that the regulators could rectify the “substitute holding” business and irregular Class C account trading activities in the interbank bond market and have already banned the opening of new class C account.

Here's more from Barclays:

Substitute holding and Class C account trading could bear high risk, because 1) substitute holding usually does not have formal agreement and could create market disruption if there are disputes,

2) Class C accounts usually have excessive leverage, and 3) market participants could mis-use Class C accounts to do irregular activities, such as illegal profiting by fund managers through personal connections and illegal trading.

Despite no official data, we estimate around RMB 900bn (3% of interbank bond market’s outstanding balance at end-Mar 2013) invested in the interbank bond market through the Class C accounts by the non-bank financial institutions could be affected by the PBOC’s regulatory tightening, but no impact on banks’ WMPs.

We believe the regulatory tightening could lead to a moderate deleveraging of investment products and, temporarily, lower demand and higher bond rates. However, the regulatory tightening could reduce the risk in bond trading in the long term, in our view.

Advertise

Advertise