News

Bank of China Hong Kong warns of fraudulent website

The case has been reported to the HKMA and the local police force.

Singapore to eliminate use of all corporate cheques by 2025

Cheque transactions have declined by almost 70% between 2016 to 2022.

Hang Seng Bank raises HKD prime lending rate to 5.875% per annum

Its savings deposit rate is also being increased.

BEA raises standards savings rate to 0.875%

Its HK dollar prime rate has been increased to 6.125% per annum.

Bank of China (Hong Kong) adjusts HKD prime rate to 5.875%

The savings deposit rate will also be adjusted to 0.875% for accounts with a $5,000 balance and above.

UOB net profit up 53% in H1; 85 cents interim dividend announced

Net profit was S$1.4b in Q2 when including the one-off Citigroup integration expenses.

StashAway, family office firm to offer clients with more investment options

ACP clients can invest in private equity managers such as KKR, SilverLake, and Khosla Ventures.

BigPay revamps mobile application interface

The redesign now features a floating navigation bar.

South Korean banks to maintain eased lending stance in Q3: report

There are less banks who will ease their lending stance compared to Q2 and Q1, however

Malaysia’s Public Bank extended $2.6b 'affordable home' loans in 2022

The bank has given out RM67b in commercial loans to Malaysian SMEs.

Exceptional banks and financial institutions recognised at Asian Banking & Finance Awards 2023

Industry players across the region gathered in Singapore to celebrate their wins at the Wholesale Banking Awards, Retail Banking Awards, and Corporate and Investment Banking Awards

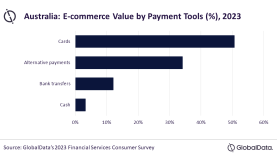

Chart of the Week: 1 in 3 online transaction in Australia use alt payments

The e-commerce market will be worth $51b in 2023, according to GlobalData.

Weekly Global News Wrap: UBS shoulders US$388m payment over CS’s Archegos ties; UK to meet with banks on account closures

US authorities tell banks to fix inaccurate financial statements.

Mizuho Bank highlights innovation in new corporate tagline

It comes after the Japanese megabank launches its new medium-term business plan.

Thai regulator warns of weakening debt serviceability, bond market

Slower-than-expected income recovery and rising cost of living are hitting households.

GoTyme makes a splash in digital banking in the Philippines

Co-CEO Albert Tinio shares how mobile apps, digital kiosks and partnership with Robinson Group aided GoTyme Bank’s successful entry into the market.

Advertise

Advertise