News

Hong Kong banks to have a 'very good' capital buffer for the next 12-18 months: Moody's

That is in response to the move towards more stringent regulatory requirements.

Hong Kong banks to have a 'very good' capital buffer for the next 12-18 months: Moody's

That is in response to the move towards more stringent regulatory requirements.

Big banks fail to keep up with Chinese fintech giants in mobile payments

The value of third-party payments in China grew more than 74 times from 2010 to 2016.

Here's how Singapore banks fared in Q2

DBS, OCBC, and UOB reported growth in fee income.

Weekly Global News Wrap Up: Paris to beat Frankfurt in banking post-Brexit; British banks' rehabilitation plans thwarted by US DoJ delays

And Deutsche Bank is no longer in the list of the world's top 15 private banks.

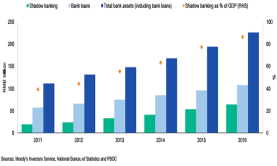

Chart of the Week: Shadow banking in China more than doubled since 2012

Shadow banking assets reached US$9.5t in 2016, but growth is finally slowing down.

Australian banks face heightened risks from slowing housing market

A softening housing market will weigh on banks' profitability as credit growth slows.

Malaysian banks' interest spreads suddenly contract to 1.49% in June

But we have yet to see if this is a trend.

Indian banks' non-performing assets more than doubles in two years

Gross NPAs grew from US$47b in March 2015 to US$110b this year.

Hong Kong banks expected to report stable profits in 2017

Fee income will improve in the next 12-18 months.

High foreign currency loan-to-deposit ratio a potential risk for Thai banks

The banks' foreign currency LDR is amongst the highest in ASEAN.

Australian banks could be scrutinised after latest banking scandal

An analyst says a formal public inquiry into the sector may be on the cards.

Malaysian banks' loan growth hit 5.7% in June

Household loans grew 5% in the same month.

Singapore banks' Q2 financial results say the worst could finally be over

DBS, OCBC and UOB met earnings expectations in Q2.

China extends deadline for banks to submit risk assessments

Eight sets of rules were launched by the CBRC since March.

Hong Kong banks' problem loan ratio to remain stable over the next 18 months

The banks' asset quality is expected to be resilient.

Weekly Global News Wrap Up: Banks may need $50b additional capital post-Brexit; European banks beat US rivals; Swedish banks launch robots

And the Financial Conduct Authority considers banning unarranged overdraft charges.

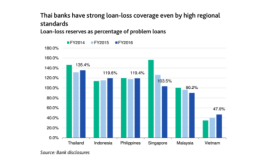

Chart of the Week: Thai banks' strong loan-loss coverage

The banks' loan-loss coverage ratio is the highest in ASEAN.

Advertise

Advertise