News

Weekly Global News Wrap Up: US banks' profits up 10.7% to $48.3b; How big tech is disrupting banks

And find out why Frankfurt and Dublin seem to be winning the battle for Brexit jobs.

Weekly Global News Wrap Up: US banks' profits up 10.7% to $48.3b; How big tech is disrupting banks

And find out why Frankfurt and Dublin seem to be winning the battle for Brexit jobs.

Chart of the Week: Singapore banks' ROEs to trend higher into FY18-19E

Maybank Kim Eng outlines three reasons behind this forecast.

Indian banks remain 'moderately capitalised'

Overall Capital Adequacy Ratio stood at 13.74% as of March 2017.

Why the property sector remains a key risk for Hong Kong banks

The prevalence of high-LTV second mortgages increases default risks for homebuyers.

Malaysian banks' total system deposits growth slows to 3.5%

Government deposits contracted for the 12th consecutive month.

More unfavourable regulations to impact Thai banks

Policies may even target leasing companies as well.

Outstanding balance of bank-issued wealth management products in China up 9% to US$4.3t

It represents almost a fifth of bank deposits.

Australian banks' compliance issues get exposed

Thanks to the recent money laundering crackdown.

What will drive Singapore banks' sharp loan growth recovery?

The 7.6% growth in July was a significant improvement from the low of -2.7% in May 2016.

This promising segment could prove lucrative for Australian banks

That is if banks can tailor a unique package of services for their needs.

Weekly Global News Wrap Up: Big banks beset by a US$340b bill for poor conduct; Bitcoin's unprecedented growth spur crypto-bubble fears

RBS to cut 880 IT jobs and Goldman Sachs to use personality tests in hiring.

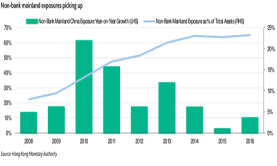

Chart of the Week: Hong Kong banks' mainland exposures to pick up in the next two years

That is following a period of steady decline starting in 2014.

Two reasons why rising NPLs will continue to haunt Thai banks in 2H17

The weak SME economy is partly to blame.

Traditional lending in China sees a 'renaissance' as shadow banking slows down

Net corporate bond issuance has been increasing.

Two ways for Australian banks to achieve 'unquestionably strong' capital ratios

Both methods are likely to be negative for shareholders.

Malaysian banks' gross impaired loans ratio improved to 1.64%

Loan loss coverage was stable MoM at 83.2%.

Indian banks' profits were severely impacted by these two things

NIMs declining for the last three years is one.

Advertise

Advertise