News

Why the slowdown in China's shadow banking is not as good as it seems

The borrowing is just moving around.

Why the slowdown in China's shadow banking is not as good as it seems

The borrowing is just moving around.

Australian banks vulnerable to 'second order effects' from the housing market

Mortgages already account for 63% of banks' loan books.

Which Singapore bank showed the most improvement in its capital ratio?

UOB beat its peers in terms of capitalisation.

Here's why Philippine banks' NPLs are unlikely to rise

NPL levels have already started to decline in 1H17.

Malaysian banks' business deposits hit double-digit growth for the first time in 5 years

It grew 11.3% in September.

Here's why the new rules on foreign majority ownership in the financial sector is a boon for China banks

Its effect will be more pronounced amongst smaller financial institutions.

Weekly Global News Wrap Up: Is it time to end the separation between banks and commerce?; Regulator warns against regulatory rollback

And Wall Street bankers' bonuses could increase 10% this year.

Chart of the Week: Singapore banks' NIMs improve modestly

Thanks to rising interest rates in Singapore and the US.

Philippine banks to rely less on trading gains in 2018

Trading and forex income could decline by 6%.

China's big four banks hit double-digit net interest income growth

BOC registered the biggest growth at 16.1% in Q3.

Malaysian banks' total loans post weaker growth of 5.2% in September

Blame it on sluggish business loans growth.

Japanese banks could maintain CET1 ratios of around 10%: Moody's

Capital accumulation could support credit profiles amidst weak profitability.

Chinese banks' profitability expected to improve over the coming quarters

Thanks to expanding NIMs and slowing NPLs.

Singapore banks to suffer from more energy-related NPLs in Q4

Oil and gas service exposures make up 2-3% of the banks' loans.

Weekly Global News Wrap Up: European banks poaching from US rivals; New US regulator wants 'fresh look' at rules

And find out more about blockchain and biometrics in banking.

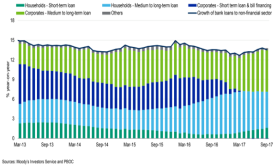

Chart of the Week: China's consumer loans on the rise

The steady increase caught the regulators' attention.

4 factors that will drive the deterioration of Vietnamese banks' capitalisation

Credit growth and provisioning costs will erode capitalisation.

Advertise

Advertise