News

Weekly Global News Wrap Up: Amazon may buy a bank in 2018; Four US banks' 'living wills' have shortcomings

And Britain's Competition and Markets Authority extends deadline for open banking implementation.

Weekly Global News Wrap Up: Amazon may buy a bank in 2018; Four US banks' 'living wills' have shortcomings

And Britain's Competition and Markets Authority extends deadline for open banking implementation.

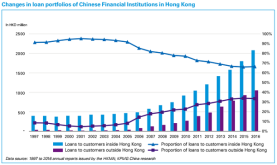

Chart of the Week: See how the loan portfolios of Chinese banks in Hong Kong changed since 1997

Their portfolios are becoming more global.

Thai banks' net interest income to grow 3.8% in 2018

Growth will be moderate despite the increase in loans.

Check out which Singapore bank is the most cost-efficient

It has the lowest staff cost per employee at US$61,800 (S$83,333). UOB Kay Hian reports OCBC leads in cost efficiency with the lowest staff cost per employee and ‘very lean’ non-wage expenses. This is against US$89,600 (S$120,830) for DBS and US$64,900 (S$87,620) for UOB. However, DBS’ staff cost per employee grew at a slightly slower CAGR at 3.6% for 2013-17, vs 4.8% for OCBC and 4.9% for UOB. Staff cost accounted for 61.6% of operating expenses for OCBC despite its lower staff costs per employee, vs 56% for DBS and 55.3% for UOB in September 2017. DBS also leads in productivity with the highest income per employee at US$399,500 (S$538,805) as of 3Q17 (annualised), significantly above the US$239,800 (S$323,465) for OCBC and US$267,900 (S$361,289). This is mainly due to its established presence in Singapore and Hong Kong with market shares, which are major financial centres, estimated at 20.6% and 4.2% respectively. According to UOB Kay Hian, OCBC and UOB's income per employee grew at a faster CAGR at 4.7% and 5.6% respectively for 2013-17, vs 2.1% for DBS. OCBC’s income per employee stayed flat in 2015 and 2016, possibly held back by the integration of Wing Hang Bank, but had improved 11% ytd in 9M17. UOB’s income per employee has grown steadily at CAGR of 5.6% for 2013-17. DBS has the highest PPoP per employee at US$232,600 (S$313,701), vs US$135,400 (S$182,703) for OCBC and US$151,500 (S$204,284) for UOB. OCBC and UOB registered faster growth with PPoP per employee expanding at CAGR of 4.4% and 4.9% respectively for 2013-17, vs 2.1% for DBS. DBS has the smallest workforce at 23,114, whilst OCBC had the largest headcount of 29,161 as of September 2017. UOB has kept headcount relatively unchanged as it maintains an ASEAN-centric footprint and did not partake in any major M&As.

Malaysian banks' earnings growth to slip to 6.5% in 2018

It's a steep decline from the 13.4% profit growth in 2017.

How will the IFRS 9 implementation in 2018 affect banks?

The financial impact should be moderate and manageable.

Australian banks' asset performance mildly deteriorated in 2017: Moody's

Overdue loans grew despite the fall in impaired loans.

Almost half of Chinese banks in Hong Kong to focus on RMB internationalisation in 2018

Hong Kong will be the first and biggest beneficiary of the trend.

Weekly Global News Wrap Up: Post-crisis banking rules finally signed; Big banks won't support bitcoin futures launch

And find out if 2018 will be the year of the Bank of Amazon.

Chart of the Week: Here's the breakdown of Thai banks' NPL formation over 10 years

NPLs should stay flat in 2018.

Banks urged to brace for geopolitical and regulatory tensions in 2018

Banks also need to prepare for increased competition from non-traditional players.

Outlook for Chinese banks 'stable' through 2018: Moody's

Thanks to strengthening government regulations and stable economic growth.

Singapore banks can save over 10% from fintech

Moreover, about 41% of banked balance has now abandoned traditional channels.

Malaysian banks' core net profit forecast to grow 5.8% in 2018

Earnings growth could taper off next year.

Thai banks' loan growth could reach 6.7% in 2018

But banks are still reluctant to lend due to credit risk concerns.

Hong Kong banks to benefit from subsiding asset pressure in 2018

The banks have emerged from a shallow episode of asset deterioration in 2016.

Weekly Global News Wrap Up: Canadian bankers' bonuses up 11% to $11.3b; Big US banks to benefit from new tax bill

And regulatory woes dampen investor appetite for European banks.

Advertise

Advertise