Hong Kong’s Mox Bank one of fastest growing digital banks worldwide

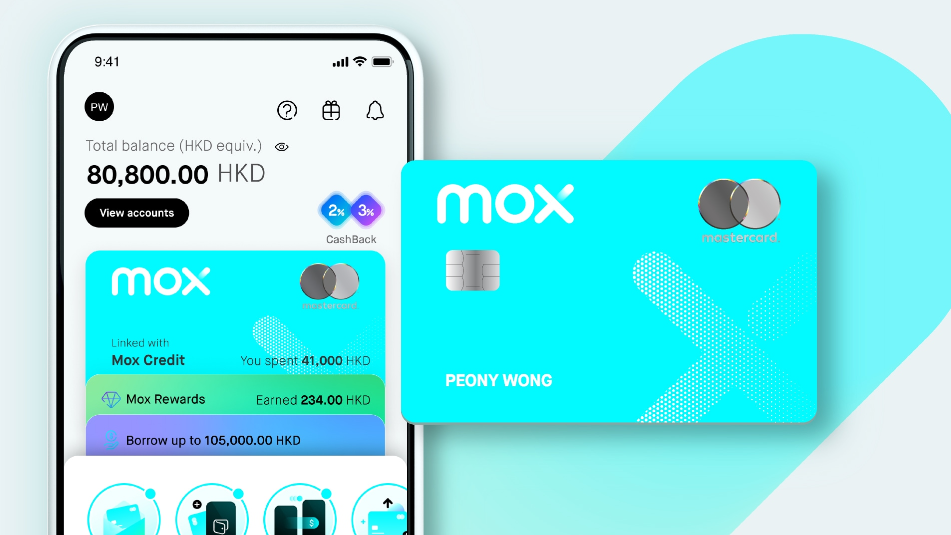

Mox has the 7th largest credit card book in the city and has 550,000 customers.

Hong Kong virtual lender Mox Bank has been named as one of the fastest growing digital banks in the world by management consulting firm Oliver Wyman.

Oliver Wyman particularly emphasized Mox's speed to market with launching a wider range of products and services compared to other digital banks globally.

Just three years since its launch, Mox reportedly holds Hong Kong's seventh largest credit card book among all retail banks in the city and has accumulated more than 550,000 customers, representing more than 10% of the bankable population in Hong Kong.

Close to 30% of Mox’s customer base holds four or more products with the bank. Services offered include deposits, foreign exchange, payments, personal financial management, cards, lending, investments covering equity and fund trading services.

ALSO READ: Hong Kong’s Mox Bank offers digital money transfer services in 10 currencies

The bank also boasts one of the highest transaction volumes per card in Hong Kong, Mox Bank said in a press release.

Mox CEO Barbaros Uygun said that the recognition underscores the bank’s success in setting a global benchmark for digital banking innovation.

"Our focus isn't solely on speed; it's about understanding the dynamic needs of the Hong Kong market and delivering solutions with unmatched agility,” Uygun said, speaking to attendees of Money 20/20 Asia in Bangkok.

“We're proud of our rapid growth, but even more so of our unwavering commitment to putting our customers' evolving needs first,” Ugyun added.

Oliver Wyman partner Dan Jones praised Mox Bank’s performance, calling it “extraordinary” compared to global digital banks, especially in the pace it released new services.

Notably, Mox’s tech stack and processes have been successfully ported to Trust Bank in Singapore, accelerating Trust Bank to be one of the first digital banks launched in the Lion City.

Advertise

Advertise