A branch of Hang Seng Bank.

A branch of Hang Seng Bank.

Hang Seng Bank reduces lending rate, deposit rates

Its prime lending rate and deposit rates are now 25 basis points lower.

Hang Seng Bank has reduced its Hong Kong dollar prime lending rate and Hong Kong dollar savings deposit rates.

Its prime lending rate has been reduced by 25 basis points to 5.625% per annum.

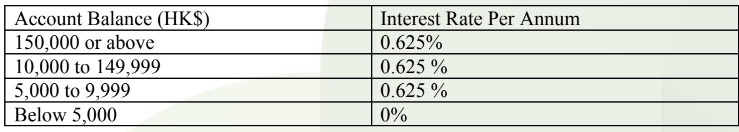

Meanwhile, for Hong Kong dollar savings deposit rates with an account balance of HK$5,000 or above, the rate has been reduced to 0.625% pa from 0.875% pa previously.

Earlier, another Hong Kong-headquartered bank, Bank of East Asia, also reduced its deposit rate to 0.625% pa.

Hang Seng executive director and chief executive Diana Cesar said that the bank hopes that the move to reduce the prime lending rate will “help support Hong Kong’s economic recovery.”

“In view of the high financing costs faced by individuals and businesses, and the challenges in Hong Kong’s economy, we have decided to lower the Hong Kong dollar prime lending rate,” Cesar said in a press release announcing the reduction.

Advertise

Advertise