China

Chart of the Week: Chinese P2P players halved in 2018 amidst tougher regulations

Active P2P investors also fell 45.2% to 2.3 million.

Chart of the Week: Chinese P2P players halved in 2018 amidst tougher regulations

Active P2P investors also fell 45.2% to 2.3 million.

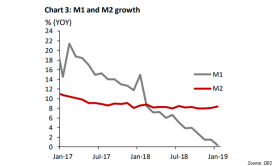

Will China soon cut banks' reserve ratio further?

Analysts weigh that an RRR cut is still needed considering liquidity conditions.

Chinese megabanks caution against bad loans as year-end profits take hit

Lenders also sharply increased provisions for future bad debt.

China Construction Bank's Q4 profit falls to $6.02b

This represents the first quarterly decline in three years.

Chinese megabanks extend profit decline as credit boom fades

Shanghai- and Shenzhen-listed banks are likely to see 6.7% increase in profit.

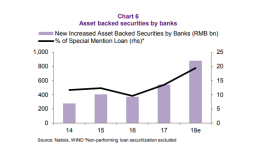

Bank-backed asset securities in China hit $131.12b in 2018

Almost 30 banks have unveiled plans to set up WM units following clearer policies.

Chinese banks suffer heavy losses as delinquencies hit $17.88b in January

The energy sector saw the most defaults of $6.94b.

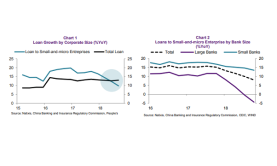

Implication of NPC for Chinese banks: Sticks and carrots to force lendings to private firms in exchange for more capital

During the 13th National People's Congress (NPC), Chinese Premier Li Keqiang presented the government work report. Whilst the market read the new growth target (6-6.5%) rather negatively, Premier Li Keqiang was very transparent about the difficulties in reaching this target and the fiscal and monetary expansion which will be needed to achieve them. Whilst a lot has been written about tax cuts as well as lowering the still high reserve requirement ratio (RRR), less has been commented on how banks will be affected by the measures announced during the NPC. Li Keqiang made a number of specific announcements on this front. a) lower funding costs for small-and-micro enterprises (SMEs); b) 30% growth in state-owned commercial banks’ lending to SMEs from negative growth in 2018; and c) extending the maturity of loans, especially for manufacturing firms.

Chinese banks raise record-high $48b in Q1 to plug capital crunch

Banks have been allowed to issue perpetual bonds to improve solvency ratios.

Chart of the Week: Can Chinese banks plug SMEs gaping credit crunch?

Loans to SMEs by SOCBs dropped to -4% in 2018 from 12% the previous year.

China to let up on shadow banking crackdown in 2019

Shadow banking assets fell to around 68% of GDP in 2018.

Chinese banks urged to ramp up lending to rural businesses

Outstanding loans to rural areas already hit $4.91t in 2018.

ICBC unveils first Philippine branch

It is the 12th foreign lender to secure a license after the country loosened up the industry to global players. The Industrial and Commercial Bank of China (ICBC) commenced its operations in the Philippines two months after it secured its license from the Bangko Sentral ng Pilipinas (BSP), reports BusinessWorld. Located in Taguig, Metro Manila, the branch started its operation after registering with the Securities and Exchange Commission in August and securing a banking license from the central bank in November. Following the law passed in 2014 which loosens up local banking to global players, ICBC is the 12th foreign lender to secure a license from the central bank to start operations in the Philippines. The lender is also the first China bank to set up operations in the country after the Bank of China’s kickoff back in 2002. ICBC’s Manila venture comes amidst warmer trade ties between China and the Philippines after President Rodrigo Duterte’s announcement of a ‘pivot’ towards China during his Beijing visit in 2016.

Chinese banks' new loans falls sharply to $131.8b in February

This is only a third of the $480.75b in loans issued in January.

Trade tensions fail to rattle Chinese banking outlook: survey

Two in 5 bankers believe China’s economy will grow by around 6.5-7%.

Chinese banks' record-high lending boost only short-term gains

Short-term loans surged 57.8% in January whilst mid- and long-term loans only rose 5.3%.

Japanese players cash in on China's financial opening as US banks flounder

JPMorgan Chase is still stuck in application stage despite passing an application in May 2018.

Advertise

Advertise