China

Chinese banks extended $238.92b loans in September

This exceeded analysts’ expectations of $197.9b.

Chinese banks extended $238.92b loans in September

This exceeded analysts’ expectations of $197.9b.

China's tech titans leave little space for foreign players

AliPay and WeChat command 93.7% of the fintech market.

Chinese bank loans up to $170b in August as stimulus kicks in

Household loans hit $92.25b.

China's dual banking system: consolidation as the final solution to weak small banks

The latest bailout of Bank of Jinzhou shows the intervention by the People's Bank of China (PBoC) on Baoshang Bank was not an isolated event. There are indeed fundamental solvency and liquidity issues for some small Chinese banks, widely influencing both bond market as well as broader financial sector.

Will regional bank distress threaten China's fragile financial stability?

Failure at the regional level may squeeze funding options for the NBFI sector.

Small Chinese banks lead profit growth in H1

City and village banks saw net profit grow 13.7% compared to 4.8% for the Big 4.

For better or worse: Chinese banks court risk in deepening ties with insurers

Insurers are lining up to snap up perpetual bonds, with $32.14b of such instruments already hitting the market.

Deutsche Bank names Jeffrey Yen Chieh Peng as China Onshore WM Head

He joins from Bank of Singapore.

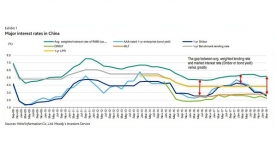

New prime rate mechanism poses risk to Chinese bank profitability

With narrower loan margins, some banks may turn to riskier activities to boost earnings.

China tightens ownership rules of unlisted banks

The move comes after the takeover of Baoshang Bank.

Chinese bank branches hit 228,600 in 2018

Around 5,600 branches were set up in far-flung communities.

China's shadow banking assets fall to two-year low in Q1 even as crackdown eases

Core shadow banking activities have dropped to $420b in 2018.

JPMorgan launches innovative cross-border payments solution

It will utilise a linked customs declarations number.

Chinese banks' loan growth up 15% to $170.7b in May

It was lower compared to the $180b worth of new loans expected by analysts.

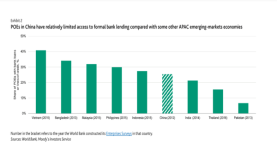

Which Asian banks have the freest credit line for POEs?

China is lagging behind with share of POE bank loans just at 26%.

China launches risk hedging tool to ease jitters after Baoshang Bank takeover

It is offered to investors in the $289m worth of six-month certificates of deposit.

Too crowded bets on “7” for USDCNY could be dangerous

Chinese yuan has been under pressure in recent weeks due to the double dip in recent ecomomic data and more importantly, the escalating trade war with the US. Since then, the CNY has shown weakness against USD, breaking 6.9 versus the USD, but also against major global currencies. The looming prospect of the China-US relationship, as well as a likely continued lax monetary policy in China, has all pointed to a weaker yuan, at least in the short term.

Advertise

Advertise