Queensland, Australia (photo from the City of Gold Coast via Unsplash).

Queensland, Australia (photo from the City of Gold Coast via Unsplash).

Aussie mutual lenders may consolidate to fewer than 10: analyst

Up to 40 mutual lenders may consolidate and potentially disappear, said S&P analyst Lisa Barrett.

In the future, there could be less than 10 mutual lenders active in Australia as consolidations ramp up over the next two years, reports S&P Global Ratings.

This comes as the lenders may seek to form entities that have about A$20b in total assets– a factor that is emerging as the new scale to be competitive in the Australian retail banking market, said S&P primary credit analyst Lisa Barrett.

Up to 40 lenders face consolidation and potentially disappear due to the ongoing mergers, Barrett said.

"Merging provides smaller lenders greater economies of scale. This should make them more efficient and able to price competitively,” she said.

Two mergers have already taken place in the past three years: In August 2021, Newcastle-based Greater Bank and Newcastle Permanent Building Society banded together to create the Newcastle Greater Mutual Group, which now have total resident assets of A$24.4b.

This was followed by the People’s Choice Credit Union and Heritage Bank merging to become the Heritage and People’s Choice Ltd. in 2023, with total assets of A$26.9b.

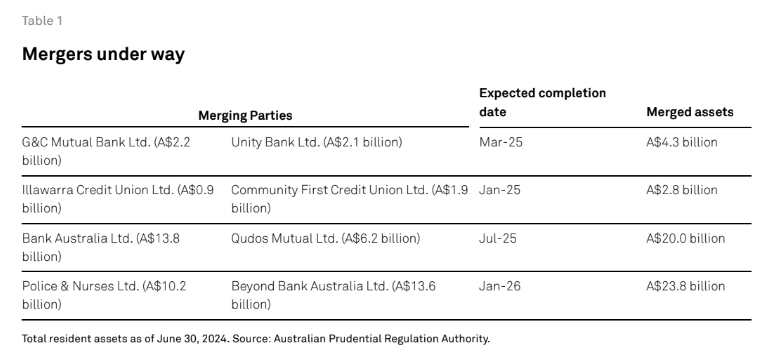

Over the next two years, two other murders will create lenders that have A$20b in total assets: Bank Australia and Qudos Mutual combined have around A$20b in assets, whilst Police & Nurses Ltd. and Beyond Bank Australia is expected to become a A$23.8b entity by January 2026.

“The ongoing requirement to invest in technology to keep up with customer expectations and industry trends adds further fuel to the merger fire,” Barret said.

Not all the mergers will create A$20b entities. G&C Mutual Bank and Unity Bank’s merger will form an entity that has A$4.3b in assets; and the merger of Illawarra Credit Union and the Community First Credit Union will form a lender that has A$2.8b in assets.

Advertise

Advertise