How can banks use data to protect market share, satisfy customers and respond to regulatory pressures?

Find out from IBM, Nomis Solutions, and Gemalto.

When a large Indonesian bank struggled to determine the actual size of its customer growth and its annual growth rate, its executives knew right away that something was wrong with how they managed customer data. Lacking clear visibility of accurate numbers, the bank’s executives had a difficult time analysing needs and strategising to promote future growth. Furthermore, the bank needed to comply with regulations from the central bank that required all banks in the country to establish an aggregated representation of customer data.

IBM then stepped in and worked with the bank to implement a single customer view solution which has helped the bank to identify identical customer information 30% faster than before, and establish clear and accurate visibility of customer data that complies with national banking regulations.

This is not a unique scenario in the industry as more banks, up till now, strive to find the most efficient way to manage customer data and take advantage of its potential. According to Tan Jee Toon, ASEAN director at IBM Analytics, over the past few years, banks have been immensely pressured to adopt newer business models to drive profitability with the advent of the digital economy, increasing consumer empowerment, the rise of a new generation of nimble fintech competitors, and ever-expanding regulatory scrutiny.

“To address these challenges, data about the evolving needs of one’s customers, risk and fraud management, regulatory requirements, business trends, and competitive environment, have naturally become more critical,” he adds.

Satisfying customers

With the ubiquity of customer banking data, it is easy for banks to take seemingly random figures and information for granted. However, banking data play a critical role in satisfying customer segments, protecting market share against competitors, as well as responding effectively to regulatory pressures.

Customer data present several opportunities for banks when it comes to customer service. “To capture market share and acquire more customers, banks need to know what their customers are looking for,” advises Alex Tay, director, identity and data protection for ASEAN at Gemalto.

As banks are equally into the customer service sphere as they are in the financial sector, it would benefit them if they are intimately aware of their customers’ behavior through the data the latter regularly provide.

“By collecting and analysng user behavior data, banks can gain insights into what services their customers are using, and how they are using it. From there, banks can introduce new services of interest or tweak current features to improve ease of use—measures that greatly improve market share and user experience,” Tay adds.

Customer information matters

Damian Young, managing director, EMEA at software company Nomis Solutions, agrees. He believes that banking customers rely heavily on an image that banks must be able to utilise in order to realise potential gains.

“The key to successfully protecting and even growing market share is redefining ‘what good looks like’ for existing customers. The first and possibly most crucial step is to achieve a better understanding of customers and identify what they are looking for from their bank, helping drive retention, book size, and ultimately their return on assets,” Young explains. He considers price optimisation software as the “most effective tool a bank can use here” thanks to the big data already in their possession.

“By collating customer information onto a single big data platform, it can calculate an optimum price for any given product, specific to each customer—thus retaining loyalty while maintaining healthy rates of profitability,” Young says.

Young also points out to an array of specific information that lenders can tap to this end. “Banks can also access an in-depth assessment of consumer attributes, behaviors, and sensitivity, creating a strategy that will not only identify the right price position in terms of retention, but also drive customer acquisition strategies, customer satisfaction goals, product design, channel selection, and marketing/sales strategies,” he adds.

A tool in regulatory compliance

Accessing customer data also aids banks in meeting various regulatory requirements, the number of which have more or less increased since the global financial crisis.

“Banks are challenged daily to balance opportunities and risks amidst today’s fast-paced business environment and increasing regulatory demands. By better leveraging unstructured and structured data, banks can lower business risks, counter financial crime, apply intelligent automation to processed such as compliance, and better support informed risk-based decisions to drive improved business outcomes,” Tan says.

This comes as regulators now look to working closely with lenders and are thus more open to utilising bank data for various results. “The regulatory authorities that are looking to establish fair pricing, open lines of communication, and offer timely availability of relevant information will be keen to encourage these developments in market competition, and banks need to ensure they have the weapons in their armory to make full use of the data available,” Young says.

Data security

Still, regardless of strategy or approach, banks need to ensure that customer data remains secure, given the growing concern over data security.

“In truth, no financial institution can afford to be complacent because any organisation can be the victim of a costly security breach, regardless of size. An effective data security approach will allow banks to be more flexible in adapting to market changes, and remain competitive to threats and opportunities, subsequently helping them to gain more market share,” Tay explains, adding that with security now no longer an impediment, security now becomes an enabler that “fuels business differentiation and innovation.”

At the end of the day, the critical burden that falls on banks is data interpretation—how to make sense of the data in order for these to become useful to their operation.

“It is important to remember that data in itself is one-dimensional. The key here is for banks to extract the insights and intelligence behind the data they have. In other words, banking and financial services leaders must be smarter in how they approach data,” says Tan.

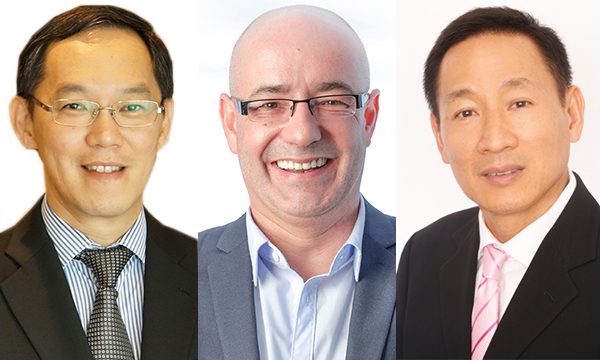

In photo (from left to right): Tan Jee Toon, Damian Young, and Alex Tay

Advertise

Advertise