News

It is finished: Standard Chartered China wraps up RMB FX option transactions with corporate clients

In line with the SAFE’s regulatory announcement.

It is finished: Standard Chartered China wraps up RMB FX option transactions with corporate clients

In line with the SAFE’s regulatory announcement.

Job opening thrives in Singapore's financial services, accountancy sectors

This is for the next 6 months.

Here's what props Singapore banks up despite margin pressures

And cut-throat competition among banks.

Deutsche Bank wraps up first series of RMB option trades for Chinese corporates

In line with the new SAFE regulation.

OCBC 1H14 results slammed expectations with 38% profit jump

Thanks to strong rebound in MTM gains.

Bank of East Asia 1H14 net profit up 6% y/y at HK$3.58b

Reflecting non-interest income that exceeded expectations.

APAC banks have to deal with slower credit growth and closer monitoring: Fitch

Due to credit cycle changes.

National Australia Bank’s sale of UK real estate loans is a good move: Moody's

Because it will improve NAB's asset quality.

Reforms in China banks poised to be next catalysts

Reform plans could improve NPL visibility.

Maybank dives further into premium card segment with Visa Signature

It's expected to boost credit card billings.

Philippine-based BDO's 1H14 net income slides 22% to PHP11.1b

Due to anticipated weakness in treasury income.

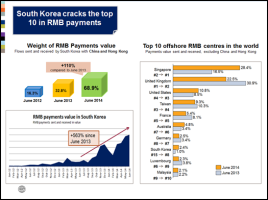

South Korea cracks the top ten in RMB payments

RMB payments surged an impressive 563%.

Slight increase in NPLs pegged for most HK banks' China loans in 1H14

Due partly to slower economic growth.

Hong Kong banks getting giddy over robust growth forecasts

Thanks partly to solid loan growth.

National Australia Bank unveils £625m sale of a parcel of loans in UK CRE portfolio

Marking step in disposing capital-hungry assets.

Krung Thai Bank's loan growth predicted to rocket in 2H14

Thanks to improving economy and political environment.

BOCOM announces deepened mixed-ownership, corporate governance reform plans

Shareholding incentive could be one reform area.

Advertise

Advertise