News

BDO's 19% drop in trading gains offset by 96% rise in FX operations

Treasury was flat but relatively strong against peers.

BDO's 19% drop in trading gains offset by 96% rise in FX operations

Treasury was flat but relatively strong against peers.

Metrobank's treasury gains down 43% to PHP1.8b

But it was offset by lower opex and provision for credit losses.

Undesirable lending practices uncovered at some local banks: Monetary Authority of Singapore

Credit underwriting standards need to be improve.

How will Hong Kong's proposed revision of the resolution regime impact bank creditors?

There is a lower likelihood of government support for banks.

CIMB Niaga's business-as-usual net profit down 59% to IDR856b in 2015

It declined 46% in 4Q15 alone.

These charts summarise Singapore banks' worrisome O&G exposures

The banks will likely suffer from deteriorating asset quality.

Indonesia's reserve requirement cut from 7.5% to 6.5%

It will free up $2.5 billion of banks' mandatory deposit reserves.

Bank Mandiri needs higher NPL buffer, warns analysts

NPLs rose despite strong 12% growth.

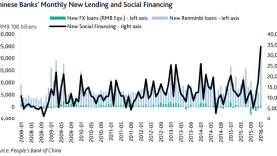

New RMB loans hit a record RMB2.51 trillion in January 2016

The pace of credit growth exceeds economic growth, analysts warn.

Maybank Indonesia's net profit surged 61% in 2015

Net profit after tax and minority interest reached Rp1.14 trillion.

Bank of the Philippine Islands' earnings down 16% to USD92m in 4Q15

Blame it on the trading income drop.

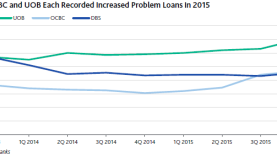

This is a make-or-break year for OCBC’s management: analysts

It’s poised to see more asset quality deterioration.

DBS’ net profit jumps by 20% to $1b in 2015

On back of higher non-interest income.

Thai banks' gross NPL down 6.2% to THB335b at the end of 4Q15

NPL ratio of every bank fell from 3Q15, except for KBANK and TMB.

OCBC’s net profit inches up 2% to $3.91b in FY15

Thanks to associates’ increased contributions.

How will the proposed liquidity tightening affect Vietnamese banks?

The share of short-term funding that banks can use for loans will be decreased.

UOB’s FY15 net profits dip 1.2% to $3.21b

Due to a higher tax provisions write-back in FY14.

Advertise

Advertise