News

Weekly Global News Wrap Up: European banks to lose more market share to US banks; HSBC to advise on world's biggest IPO

And Deutsche Bank is fined $156m for forex violations.

Weekly Global News Wrap Up: European banks to lose more market share to US banks; HSBC to advise on world's biggest IPO

And Deutsche Bank is fined $156m for forex violations.

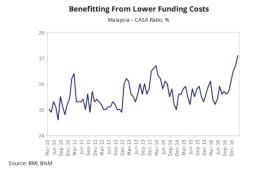

Chart of the Week: Malaysian banks to benefit from lower funding costs

Thanks to the system's CASA ratio rising to a multi-year high of 27.1% in February.

Smaller banks in China post weaker capital and liquidity positions

This is due to their faster asset growth rate.Moody's Investors Service says that the 2016 results of the 11 listed Chinese banks rated by Moody's continued to testify to profitability pressures from China's slowing economic growth, despite the absence of any significant deterioration in reported asset performance.

Thai banks strong enough to weather consumer lending slowdown: analyst

Thanks to the banks' strong capital positions.

Banks withdraw from $1.7t worth of Chinese investments

As banks pull out, Chinese bonds and equities retreat, says Bloomberg.

Philippine banks to see positive growth over the medium term

Thanks to strong economic growth in the country.

Taiwanese banks' profitability to recover modestly in 2017

Loan demand will also pick up to mid-single-digit growth.

Indonesian banks to finally see a slowing pace of NPL growth

Credit uptake will likely increase in the coming quarters.

Chinese banks to remain under pressure even after growing their profits in 2016

Net interest margins will continue to narrow and asset impairments will increase.

Singapore banks' ROEs to stay depressed at 8-9%

NIMs are expected to remain muted with only a 1-2bp pickup.

Chinese banks' 2016 results prove profitability pressures persist

Smaller banks reported weaker liquidity positions.

Taiwanese banks' profitability and asset quality expected to recover this year

Loan demand will also pick up to mid-single-digit growth.

Here's why the 2017 Asian Banking and Finance Retail Banking Forum Singapore is worth attending

The event will be held on April 26 at the Pan Pacific Singapore.

Chart of the Week: Singapore banks' domestic banking unit CASA deposits gain momentum

Banks in Singapore continue to offer attractive rates.

Weekly Global News Wrap Up: Goldman Sachs, Bank of America report increased profits for Q1; Wells Fargo tests Facebook chatbot

And find out how regulators risk putting banks on a fast track out of London.

Indian banks urged to raise provisions as bad loans mount

Lenders are asked to make provisions at rates higher than the regulatory minimum.

China's off-balance sheet lending surged $109b in March

Bloomberg says China’s shadow banking is back in full swing.

Advertise

Advertise