News

Chart of the Week: Check out the breakdown of Thai banks' bad loans

New NPL formation dropped to 66.4% of total bad loans in 2017.

Chart of the Week: Check out the breakdown of Thai banks' bad loans

New NPL formation dropped to 66.4% of total bad loans in 2017.

Vietnam's loan growth beats new year slump after rising 5% from January to April

The government is doubling down on the country’s bad debt.

Australian bank inquiry could cut 8% of the country's finance jobs

Massive job cuts may be tantamount to losses seen during the 2008 global financial crisis.

Non mortgage loans dominate Korean bank lending in April

The government’s efforts to tighten home-backed lending appear to be paying off.

Japanese banks reportedly mulling joint ATMs to cut massive losses

Declining loan demand is squeezing the profits of the country's lenders.

Indonesia eyes tighter fintech regulations to curb loan shark activity

Fintech firms will be compelled to be registered with authorities.

Bad loans bog down Indian state banks with $1.4b loss in Q4

The banking sector is saddled with a massive $210b in problematic loans.

Number of Taiwanese bank branches plunge to five-year low in 2017

This translates to 3,417 branches still in operation.

Philippine banks profits up 17.8% in Q1

Higher earnings from trading buoyed non interest income to $691.53m.

Chinese banks' money supply received boost from RRR cut

Net interest margins are poised to widen amidst more loans to deploy.

Hong Kong banks face heightened risks from close Chinese ties: Fitch

The credit rating agency noted that China's governance standards are lower than Hong Kong's.

Limited oil and gas exposure cuts Singapore banks' bad loans in Q1

New NPL formation eased for DBS by 63%, 24% for OCBC, and 1.9% for UOB.

Wealth management fees buoy Singapore banks earnings in Q1

DBS, OCBC, and UOB all registered double-digit growth in fee income.

Hong Kong banks authorised to apply fintech in credit assessment

Instead of collecting income proof, banks may use big data and other fintech.

Housing downturn pushes Australian banks' credit growth down to 5.1% in March

Residential credit accounts for more than 60% of the banking system’s overall credit.

Weekly Global News Wrap Up: BNP Paribas profit falls 17% in Q1; BofA pushes for cashless payments

And Greece's top banks would lose $18.6b of capital under stress.

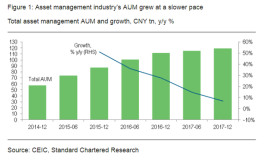

Chart of the Week: Check out the growth of AUM held by China's asset management industry

Assets under management exceeded $15.69t.

Advertise

Advertise