News

Falling credit costs soften earnings blow on Thai banks

Net profit is expected to edge up 5% in Q2.

Falling credit costs soften earnings blow on Thai banks

Net profit is expected to edge up 5% in Q2.

Hong Kong banks to hike prime rates by end-June

Tighter liquidity from mega IPOs will leave lenders with no other option.

Australia intensifies oversight over fintech lending

Moody’s lauds the move as a welcome development to improve transparency.

Malaysian bank loan growth to hit 7% in 2018

However, policy uncertainty over new leadership may dampen sentiment.

Fed hike to boost interest income of Taiwanese banks

The country’s lenders own over $30b in US-denominated assets.

E-wallets to snap up 6% of Philippine payments by 2022

However, the country is still miles behind China and India.

Two in five Malaysians open to sharing bank data

However, privacy and security concerns still mar open banking adoption.

Robots could cut 10,000 Australian banking jobs over the next decade

The four major lenders slashed over 4,000 full-time roles in 2017.

Vietnam bank loans grew 6.16% in May

This represents a slightly faster expansion than the previous months.

US tightening buoys Hong Kong banks' profitability

Funding costs are expected to stay low, boosting NIMs.

Singapore and Hong Kong lead Asia's asset management charge

Their combined assets under management (AUM) hit $91.5b in 2017.

Vietnamese banks intensify capital raising activities as Basel II deadline looms

Lenders have been using retained earnings to lift CAR.

Chinese bank credit continues to build up despite deleveraging campaign

Sustained expansion in household debt pose risks to the sector’s stability.

New loans extended by Chinese banks hit $179.51 b in May

Credit continues to build up in the system despite deleveraging efforts.

Weekly Global News Wrap Up: Switzerland rejects sovereign money initiative; Credit Suisse culls senior investment banking jobs

And JPMorgan has been sued over a Mexican property transfer.

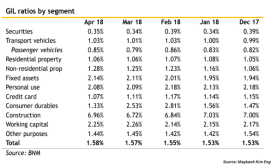

Chart of the Week: Bad loans in Malaysia inch up to 1.58% in April

The construction segment had the highest gross impaired loans at 6.96%.

Chinese fintech companies are tapping on Asia's unbanked

Indonesia and other Southeast Asian markets are the target markets.

Advertise

Advertise