News

Will virtual banks threaten Singapore's big three?

Newcomers still have to create large funding and capital bases to contend with incumbents.

Will virtual banks threaten Singapore's big three?

Newcomers still have to create large funding and capital bases to contend with incumbents.

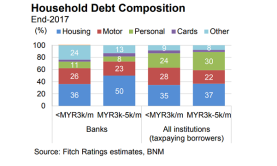

Malaysian banks bear weight of $234b household debt burden

Lower income borrowers account for 37% of household loans.

Thai bank profits to fall 1% in Q2

Thanachart Bank will get hit the hardest as earnings will fall 13%.

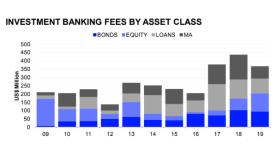

Singapore investment banking fees down 15.9% to $366.3m

Advisory fees for M&A deals shrank 49% to $76m.

Online bank hiring in Malaysia up 15% in March

It recovered from 9% decrease in the first two months of the year.

Korean regional banks look to SEA for growth

DGB Financial Group is aiming to open a bank branch in Vietnam. Regional lenders in Korea are betting on Southeast Asia for expansion amidst a saturated domestic market, reports The Korea Times. Daegu-headquartered DGB Financial Group revealed plans to open a bank branch in Vietnam after applying for license. A spokesman from the bank noted that DGB Daegu Bank acquired Cambodia's Cam Capital Specialised Bank in 2018 whilst DGB Capital launched DGB Laos Leasing Company in 2016. "We are looking for opportunities in Vietnam as Shinhan Bank did there. There are a lot of cultural similarities between Korea and Vietnam. This is one of the reasons we are seeking to launch services there," a DGB spokesman said. Also read: Foreign banks flock to Vietnam

Millennials are snapping up Asia's short-term online loans

They are the top borrowers in India, Indonesia, Vietnam and the Philippines.

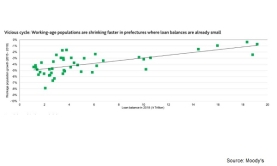

Japan's regional banks cash in on middle-risk loans

The share of real estate in total loans hit a record high 16%, thanks to regional lenders. Regional banks in Japan have been boosting their exposure to firms with higher credit risks and to the real estate sector as they battle against declines in domestic loan yields, Moody’s said in a report. As a result, regional banks have been leading systemwide loan growth, boosting loans faster than deposits. “Some regional banks' strategy is to boost what they classify as ‘middle-risk’ loans to small and medium-sized enterprises (SMEs) that rank on the lower end of creditworthiness,” the report said.

Can Australian banks meet heavier capital requirements?

The regulator is proposing an aggregate-level risk-weight floor based on internal ratings-based approach.

Malaysian banks lead Southeast Asia in board diversity

Women make up over a third of boards compared to only 9% in the Philippines.

Weekly Global News Wrap Up: Deutsche Bank to build $56b bad bank; Big Nordic banks cut compliance jobs

And banks in Nigeria are tapping on a growing youth demographic.

Chart of the Week: Indian banks' credit growth hit 13% in May

Home and retail sectors drove lending gains.

Singapore slaps three-year prohibition orders against former UBS banker

Paris Michele was discovered to have falsified company emails and forged documents.

Singapore banks step up buyback spree to rescue share price

Most of the buybacks by DBS were done in May, when the share price fell 14%. Singapore banks’ share buybacks have picked up steam in 2019. A Maybank Kim Eng report noted that DBS and OCBC have bought back more shares YTD and much earlier than they did last year. Maybank KE analyst Thilan Wickramasinghe expounded that DBS has bought back 25% YTD of the volume it bought in 2018. “Importantly, this was mostly done in May 2019, when its share price fell 14%. Historically, DBS was most active buying back shares in Q3/Q4,” the analyst said. Meanwhile, OCBC has bought back 60% of the volume it bought in 2018 and much earlier, the analyst added, noting that the DBS and OCBC buybacks in Q2 2019 are equivalent to 55% and 53%, respectively, of their treasury shares balances. Also read: Singapore's big banks are on a buying spree as share buybacks hit $116.5m “We believe this is an indicator of emerging value. Our scenario analysis suggests that non-performing loans (NPLs) would need to rise 35-80% from current levels to bump credit charges up to levels seen during the O&M crisis and GFC,” the analyst explained. The buyback spree happening in Singapore can also be observed in other markets such as the United States, Natixis chief economist for the Asia and Pacific Alicia Garcia-Herrero and INSEAD finance professor Theo Vermaelen said in a previous interview.

Malaysian banks earnings slipped 0.5% in Q1

The sector’s pre-provision operating profit is at its lowest since Q1 2017.

Chinese banks' loan growth up 15% to $170.7b in May

It was lower compared to the $180b worth of new loans expected by analysts.

Chart of the Week: Here's where Japanese banks' shrinking loan balances are hitting harder

More than half of lenders based in Chugoku, Koshinetsu, Shikoku and Tohoku earned less revenue.

Advertise

Advertise