News

Massive mergers no fix for Indian banks' near-term challenges

Credit quality and capital shortfalls remain a key problem.

Massive mergers no fix for Indian banks' near-term challenges

Credit quality and capital shortfalls remain a key problem.

Will property stress threaten to undo Malaysia's banking resilience?

Unsold housing stock may pressure asset quality.

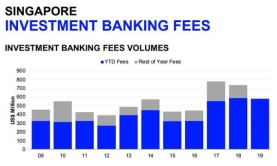

Singapore investment banking fees down 2% to $796.12m

Advisory fees for completed M&A dropped 16.5%.

Indonesian P2P lenders to disburse $30.63b in loans by 2024

The rapid growth of e-commerce will support alternative lending options.

Singapore banks embark on risky overseas pivot

Loan exposure to China has grown although loan quality has yet to be tested.

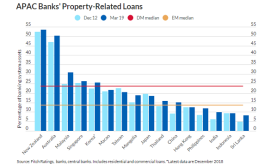

APAC banks grapple with rising property risks

In China, propety exposure has grown to 15% of sector assets.

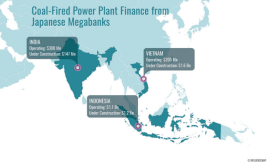

$5b of Japanese megabank loans flow into Asian coal projects

Majority of the loans are financing coal projects in India, Indonesia and Vietnam.

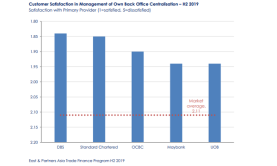

Singapore banks ace corporate customer satisfaction survey

DBS retained the crown in terms of back office centralisation.

Learn how this CEO is rethinking microcredit

Stefano Virgilli talks about Pocket Money’s role in plugging the funding gap for borrowers who failed to get access to the formal financial system.

Singapore ranks as the world's third largest foreign exchange centre

Average daily FX trading volume hit $870.63b in April.

Chinese bank loans up to $170b in August as stimulus kicks in

Household loans hit $92.25b.

Malaysian bank earnings up 5% in Q2

Investment and trading income drove quarterly profit gains.

Oliver Wyman's Shrikant Patil to join panel at ABF Digital & Open Banking Conference 2019

He will discuss how to drive innovative business models based on open data and open banking.

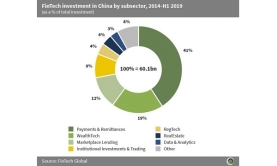

Fintech investments into China hit $60.1b in 2014-Q1 2019

Payment and remittances companies snapped up $24.7b in funding.

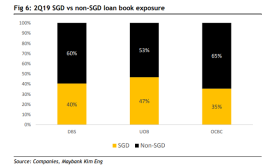

Singapore banks stomach larger asset quality risk in overseas pivot

OCBC's non-SGD loan book exposure hit 65% in Q2.

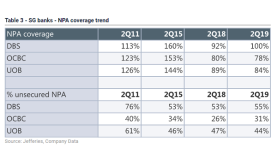

Which Singapore bank has the highest unsecured NPA?

This lender has more than half of its bad assets unsecured.

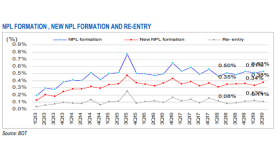

Chart of the Week: Thai banks' Q2 stressed loans hits 2.95%

NPL improvements were seen in the manufacturing and commerce sectors.

Advertise

Advertise