News

South Korean regulator to end repo agreements

This is due to improved market liquidity and reduced demands.

South Korean regulator to end repo agreements

This is due to improved market liquidity and reduced demands.

How Lendela streamlines customers' loan application process

The platform matches up customers’ loan needs from banks and lenders.

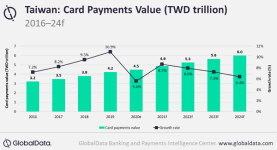

Consumer spending to spur growth in Taiwan card payments

The value is expected to reach $200.2b by 2024 at a CAGR of 7.6%.

Singapore central bank fines trust firm for money laundering holes

Asiaciti Trust committed money laundering breaches between 2007 and 2018.

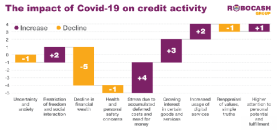

APAC banks face $1.27t in credit losses over the next two years

Chinese banks will account for $398b losses in 2020.

Weekly Global News Wrap: Germany to discuss Wirecard fallout; UBS Q2 profit falls 11% to $1.23b

And investors sue Deutsche Bank over Jeffrey Epstein scandal.

China to look into banks' quarterly green finance practices

Metrics include green finance share of total business mix.

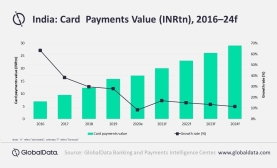

Chart of the Week: Lockdown easing drives card payments recovery in India

Fear of COVID-19 spread is driving consumers towards digital payment tools.

Global banks interested in Taiwan after passage of Hong Kong security law

The government sees the shift as a way to reinvigorate economy.

Ant Group has picked banks for $10b Hong Kong IPO: report

The company could seek a valuation of at least $200b, according to sources.

Goldman Sachs execs in Malaysia for 1MDB talks: report

Malaysia's finance minister is hopeful that it will help recover lost assets.

India mulls reducing number of state-owned banks to five

The first part would entail the sell-off of majority stakes in six lenders.

Hong Kong banks suspend return-to-office plans amidst new wave of infections

As many as 70% of Citigroup’s staff will be working from home.

Japan creates team to look into central bank digital currencies: report

It will follow-up on the BOJ’s efforts in this field.

Hong Kong-based wealth clients probed for pro-democracy ties

"Politically exposed persons" can have a hard time accessing banking services.

Singapore banks' trading print to offset lower interbank rates

Loan growth for the major banks are likely to be 1-2% QoQ.

Non-bank lending to flourish in Asia as incomes diminish

More than two-thirds have prepared for active borrowing.

Advertise

Advertise