News

Two in five Indian adults to have a digital bank account by 2026

Up to 373 million locals could open a digital-only bank account in the next five years.

Two in five Indian adults to have a digital bank account by 2026

Up to 373 million locals could open a digital-only bank account in the next five years.

Philippine banks' COVID-19 rebound faster than in 1997 crisis: banking group

Local lenders may rebound in three to four years.

Singapore central bank amends rules on managing tech risks

Financial firms should analyse and share threat intelligence within the ecosystem.

South Korean banks' loan delinquency rate flat in November

Compared to November 2019, delinquency rate is down 0.14 percentage points.

Shopee parent Sea acquires Indonesia's Bank BKE

The tech startup has raised $3b in stock offering for its business expansion plans.

South Korean banks' household loans hit $896b in 2020

This was pushed by a sustained rise in mortgage loans.

PayPal is first foreign operator to fully own Chinese payments business: report

It bought the remaining 30% stake of GoPay last December.

Indonesia's BRI to raise $1b in rights issue

It wants to strengthen its capital base for possible acquisitions.

Singapore tightens regulation of virtual payment entities to combat risks

DPT activities carry higher inherent money laundering and terrorism financing risks.

SFF x SWITCH 2020 To Feature 40 Global Satellite Events

Kicking off on 7 December, the conference features key luminaries that include Bill Gates, NZ PM Jacinda Ardern, amongst others.

Indian central bank drafts scheme for Lakshmi Vilas, DBS India merger

DBS will inject $345m into DBIL if the scheme is approved.

Weekly Global News Wrap: Full pandemic impact on Europe banks unclear til 2021; England mulls new capital rules for small banks

And Spain's BBVA sells US business to PNC Financial Services for $11.6b.

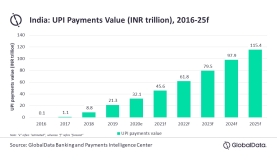

Chart of the Week: India's payments via UPI to reach $1.7t in 2025

The entrance of WeChat Pay is expected to intensify competition in the payments space.

Earnings boost for Australian banks in 2021, but headwinds persist

Deterioration in asset quality will likely emerge in 2021.

Rough road ahead for big three banks after improved Q3

OCBC, DBS, and UOB’s earnings rose in Q3—but 2021 presents a tough test as fiscal, monetary relief gets withdrawn.

Pandemic-driven rapid digital growth benefits APAC incumbent banks

Despite the rise in digital banking demand, neobanks’ performances faltered compared to incumbent peers.

Weekly Global News Wrap: UK fintechs brace for no-deal Brexit; Societe Generale to cut 640 jobs in France

And Deutsche Bank to sell IT services division to India's Tata Consultancy.

Advertise

Advertise