Thailand

Thai banks' net interest income to grow 3.8% in 2018

Growth will be moderate despite the increase in loans.

Thai banks' net interest income to grow 3.8% in 2018

Growth will be moderate despite the increase in loans.

Chart of the Week: Here's the breakdown of Thai banks' NPL formation over 10 years

NPLs should stay flat in 2018.

Kasikornbank's weakening non-interest income to be the key focal point in 2018

It will define how much the bank's earnings will recover.

Thai banks' loan growth could reach 6.7% in 2018

But banks are still reluctant to lend due to credit risk concerns.

3 reasons why Thailand's high household debt is not a threat for banks

New regulations aimed at reining in credit card debt is one.

Kasikornbank's full-year credit costs may exceed its 2.25% target

Credit costs only dipped 2% in 3Q17.

Thai banks' 3Q17 earnings 'disappointedly weak'

Profits missed consensus by 8%.

Thai banks' NPL risk to gradually improve by end-2017

Overall credit costs will still be high but will eventually ease.

Thai banks' NPLs likely rose to 3.75% in 3Q17

The sector’s earnings may have risen by only 1%.

Why Thai banks are expected to report soft 3Q17 earnings

Loan growth could weaken and NPLs could rise.

Thailand's additional 1% capital requirement for five banks credit positive: Moody's

Will they meet the requirements by 2020?

Thai banks remain strong as bad loans slow: central bank

They have CAR ratios higher than the central bank’s requirements.

Four reasons why low interest rates are a bane for big Thai banks

It could hurt the banks' investment income.

Why Thai banks are unlikely to give out extra dividends this year

Banks may need the extra capital as demand from large corporates rises.

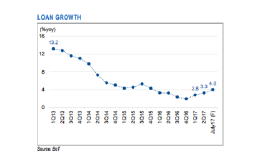

Chart of the Week: Thai banks' loan growth to hit 5% in 2017

It recovered to 3.3% in Q2.

Thailand, Indonesia report higher ratios of restructured loans compared to ASEAN peers

Such loans grew quickly in the first three months of 2017.

Why Thai banks are well placed to absorb loan losses

They have enough reserves even if 25% of thier restructured loans become NPLs.

Advertise

Advertise