Singapore

Singapore bank loans reverse slowdown in August

Loans grew 1% MoM and 5.1% YoY amidst steady expansion in business loans.

Singapore bank loans reverse slowdown in August

Loans grew 1% MoM and 5.1% YoY amidst steady expansion in business loans.

Will the fintech revolution threaten underspending Malaysian lenders?

Alibaba and Tencent, which command significant e-payments market share, could pose a big challenge.

Hear the story behind DBS's digital transformation

Trevor Cheung, Managing Director of Ecosystems, Group Technology and Operations, will share the secrets to the bank's digital dominance.

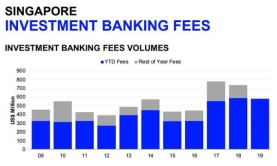

Singapore investment banking fees down 2% to $796.12m

Advisory fees for completed M&A dropped 16.5%.

Singapore banks embark on risky overseas pivot

Loan exposure to China has grown although loan quality has yet to be tested.

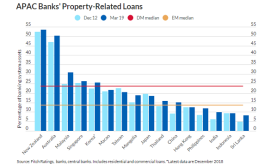

APAC banks grapple with rising property risks

In China, propety exposure has grown to 15% of sector assets.

Over 300 banks sign up to J.P. Morgan's blockchain network

Banks in Asia Pacific account for 40%.

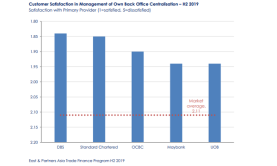

Singapore banks ace corporate customer satisfaction survey

DBS retained the crown in terms of back office centralisation.

Learn how this CEO is rethinking microcredit

Stefano Virgilli talks about Pocket Money’s role in plugging the funding gap for borrowers who failed to get access to the formal financial system.

Singapore ranks as the world's third largest foreign exchange centre

Average daily FX trading volume hit $870.63b in April.

Harnessing technology to optimise Asian trade

In a period of uncertainty for global trade, fuelled by protectionism and increasing concerns regarding a potential US-China trade war, the strength and resilience of Asian trade endures.

Tech disruptors' raid on banks: How can banks fight back?

Traditional banks are under fierce rivalry from new competitors, both big tech companies and smaller fintech start-ups. Initially, existing regulators were making it harder for new entrants to challenge banks, but this is starting to change. In Hong Kong, Chinese technology firms such as Alibaba, Tencent and Xioami were recently granted virtual banking licenses. They can now compete head-to-head with traditional banks on a level playing field. To preserve their market share, banks need to reposition themselves in the market and offer customers a better digital experience. Simply hiring a digital team and occasionally implementing stand-alone digital initiatives will fall short.

Oliver Wyman's Shrikant Patil to join panel at ABF Digital & Open Banking Conference 2019

He will discuss how to drive innovative business models based on open data and open banking.

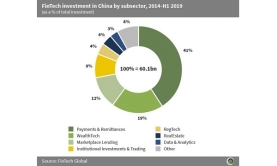

Fintech investments into China hit $60.1b in 2014-Q1 2019

Payment and remittances companies snapped up $24.7b in funding.

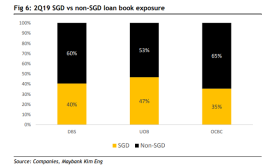

Singapore banks stomach larger asset quality risk in overseas pivot

OCBC's non-SGD loan book exposure hit 65% in Q2.

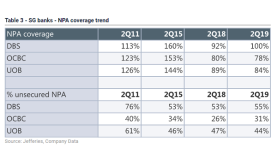

Which Singapore bank has the highest unsecured NPA?

This lender has more than half of its bad assets unsecured.

Celent's Eiichiro Yanagawa to grace the ABF Digital & Open Banking Conference 2019

He will make the case for the self-service data analytics model.

Advertise

Advertise