Singapore

Weekly Global News Wrap: ECB defends aggressive COVID measures; Risk-taking billionaires key to Credit Suisse growth

And Barclays poaches Gautam Chawla from Citigroup.

Weekly Global News Wrap: ECB defends aggressive COVID measures; Risk-taking billionaires key to Credit Suisse growth

And Barclays poaches Gautam Chawla from Citigroup.

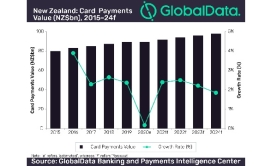

Chart of the Week: Health and safety concerns drive card payments growth in New Zealand

Card payments are expected to rise at a CAGR of 1.8% to $66b by 2024.

Singapore banks' risks abated as circuit breaker measures ease

Hong Kong’s political woes may also drive wealth business and deposits to the island’s banks.

MAS launches $1.75m global fintech innovation challenge

It comprises the MAS FinTech Awards and the Global FinTech Hackcelerator.

Bank of Singapore names new global head of products

Lim Leong Guan will concurrently be OCBC’s head of group wealth products.

Standard Chartered pilots credit card deals app CardsPal

The app has also partnered with Mastercard for exclusive promos.

MAS debunks report of large deposit flow from Hong Kong to Singapore

Don’t just refer to foreign currency deposits, Singapore's regulator said.

UOB reopens nine branches in Singapore starting 8 June

Two wealth banking centres are also reopening.

Finance firms must prepare for extended period of risk management: MAS

Close to 85% of the financial industry worked from home during the circuit breaker.

Standard Chartered names new global wealth management head

Standard Chartered has appointed Marc van de Walle as its new global head of wealth management effective 6 July, according to a press note.

Weekly Global News Wrap: Morgan Stanley shunned by Aramco for advisory role; JP Morgan, Barclays settle Mexico bond lawsuit

And Credit Suisse shrugs off oil & gas exposure.

CIMB Singapore customers band together to protest mortgage hike

More than 60 customers now comprise the group.

Risk-averse investors push Singapore bank deposits up

Foreign currency deposits skyrocketed to $19b (S$27b) in April.

Singapore's circuit breaker spells downturn in loan growth

Consumer loans were mostly affected, shrinking 0.9% MoM, OCBC said.

Falling oil prices exacerbate asset risks in Asian banks

The downturn has exposed issues in governance and operating practices.

Citi Singapore extends work from home setup until July

Majority of its 8,500 staff are working remotely.

Almost three-fifths of Singaporeans use mobile payments

62% expect that their mobile payment usage will increase next year.

Advertise

Advertise