Singapore

5 things Citi's new trade finance interactive solution allows clients to do

It was developed by Citi Innovatin Lab in Singapore.

5 things Citi's new trade finance interactive solution allows clients to do

It was developed by Citi Innovatin Lab in Singapore.

Standard Chartered appoints Chris Allington as global head, FX

In a statement, Standard Chartered announced the appointments of Chris Allington as Global Head, FX, and Neh Thaker as Global Head, Options & Platforms. Chris was most recently Head of FX, West and FX Options, and Regional Head, FXRC, Europe & Americas. He joined Standard Chartered in 2010 and was based in London. In his new capacity, Chris will take an increased leadership role with responsibilities across all FX products, and with teams across the Bank to deepen client relationships and accelerate the growth of our FX business. Chris continues to report to Nitin Gulabani, Global Head, FX, Rates & Credit, and will be based in Singapore. This appointment takes effect immediately. Neh joins the Bank as Global Head, Options & Platforms. In this newly created role, Neh will be responsible for overseeing the risks and driving the growth and product development of the Bank’s options business across the Financial Markets business. He joins from Bank of America Merrill Lynch where he has worked his entire career and most recently in a similar global role for structured products. Neh is also based in Singapore and reports to Nitin. Commenting on the appointments, Nitin Gulabani, said, “I am very pleased to have Chris take up a bigger role, and at the same time welcome Neh to the Bank. Chris’ experience and knowledge of the Bank will allow him to add even more to the FX business, while Neh’s skills will greatly complement the development of the business going forward.”

Singapore to replace Switzerland as the bank for the super-rich

To become top destination for the wealth of the world's richest by 2020.

StanChart to acquire custody business of Absa Bank

It will also manage its trustee business.

There's no stopping Asian bank's digitalisation

When it comes to Asia, digitalisation is crucial for businesses to succeed. No matter what the industry, sector or location, companies must be both online and mobile to deliver the experience their customers expect.

Privatising money in Asia

Many commentators have pointed out the circle of money that is quantitative easing and which has been responsible, ultimately, for the record highs observed this year of the Dow Jones and FTSE equity indices. Central banks print money, which is used to buy government bonds.

Six elements of a successful mobile wallet strategy for financial institutions

Mobile wallets will be the next battleground among businesses from various sectors – including financial institutions (FIs) in the fight for ownership of the consumer relationship. 2012 witnessed the introduction of myriad mobile wallet trials, and the mobile wallet wars will only continue to grow in 2013 and beyond.

Here are the 2 secrets to the success of OCBC's bancassurance business

Sales increased 160% to $268 million in 2012.

Check out UOB's paperless electronic account opening service

You can now open an account in just 15 minutes.

3 practical steps Asian banks can take to respond to regulatory change

The ongoing Libor scandal is one of the most serious breaches of control in an industry where risk and compliance failures are routinely front page news.

Maybank Singapore launches Shariah-compliant banking products

Products to finance residential and commercial and industrial properties in Johor, Melaka, Kuala Lumpur and Penang.

BNP Paribas Wealth Management appoints Dhananjai Cadambi as new team leader

He will lead relationship managers for non resident Indians in Singapore and Southeast Asia.

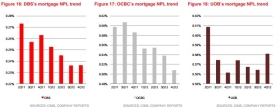

Look at the mortgage NPL trends at DBS, OCBC, and UOB

Do the cooling measures translate to burgeoning NPLs?

UOB Mobile records 1m transactions every month

More than 70% of UOB customers use the App.

StanChart has new head of transaction banking for Singapore

Motasim Iqbal has been appointed to this position.

Singapore banks' 2013 housing loan growth pegged at 8%

It's just half of 2012's feat.

Citi appoints Jervis Smith as regional head of client sales management for Asia Pacific

He will report into David Russell.

Advertise

Advertise